Understanding Hong Kong’s Special Stamp Duty (SSD) Framework

Hong Kong’s property market is renowned for its dynamism, and a persistent focus for policymakers has been the regulation of short-term speculation. Introduced specifically for this purpose, the Special Stamp Duty (SSD) acts as a significant financial disincentive for individuals and companies selling residential properties shortly after acquisition. Its primary aim is to stabilize the market, mitigating the volatility often fueled by rapid property flips. By imposing a substantial tax on such swift transactions, the government encourages longer holding periods, thereby promoting genuine home ownership and long-term investment strategies.

The SSD applies to residential properties resold within defined holding periods, measured from the date of acquisition. The duty is triggered upon the assignment or transfer of the property interest. While specific rates and holding periods may undergo government policy adjustments, the core principle remains consistent: the shorter the time elapsed between acquiring and disposing of the property, the higher the SSD rate payable. This framework is explicitly designed to penalize rapid turnover, distinguishing it from long-term investments or primary residences held for substantial durations.

It is essential to differentiate the Special Stamp Duty from the standard Stamp Duty (SD), although they can sometimes apply concurrently. Standard Stamp Duty is a tax generally levied on *all* property transfers and assignments in Hong Kong, irrespective of the holding period or property type (residential, commercial, etc.). Conversely, SSD is an *additional* duty specifically targeting the short-term resale of *residential* properties. While Standard SD rates are primarily based on the property’s value, SSD rates are determined by the holding period and are applied to the transaction price or market value, whichever is greater.

The key distinctions between these two duties are summarized below:

| Feature | Special Stamp Duty (SSD) | Standard Stamp Duty (SD) |

|---|---|---|

| Purpose | Deter short-term residential property speculation | Tax property transfers and assignments |

| Property Type | Primarily residential properties | All property types (residential, commercial, industrial, land) |

| Trigger | Resale of residential property within specific holding periods (e.g., 6, 12, 36 months) | Any assignment or transfer of property |

| Calculation Basis | Percentage of sale price or market value, tiered based on holding period | Percentage of consideration or market value, tiered based on property value (Scale 1 or Scale 2) |

| Relationship | An additional duty payable if triggered, in addition to Standard SD (if applicable) | The base stamp duty for property transfers |

Successfully navigating Hong Kong’s property market demands a clear understanding of both duties, particularly the SSD framework for anyone contemplating buying and potentially selling residential property relatively quickly. Recognizing its purpose, scope, and differentiation from Standard Stamp Duty is the fundamental step in assessing potential tax liabilities.

Critical Triggers for Special Stamp Duty (SSD) Liability

Identifying the precise events that activate Hong Kong’s Special Stamp Duty (SSD) liability is crucial for property owners and investors alike. The most straightforward and common trigger is directly linked to the holding period of the residential property. Should a property be resold within a prescribed timeframe after its acquisition, SSD becomes payable, with the specific rate directly proportional to the brevity of the holding period.

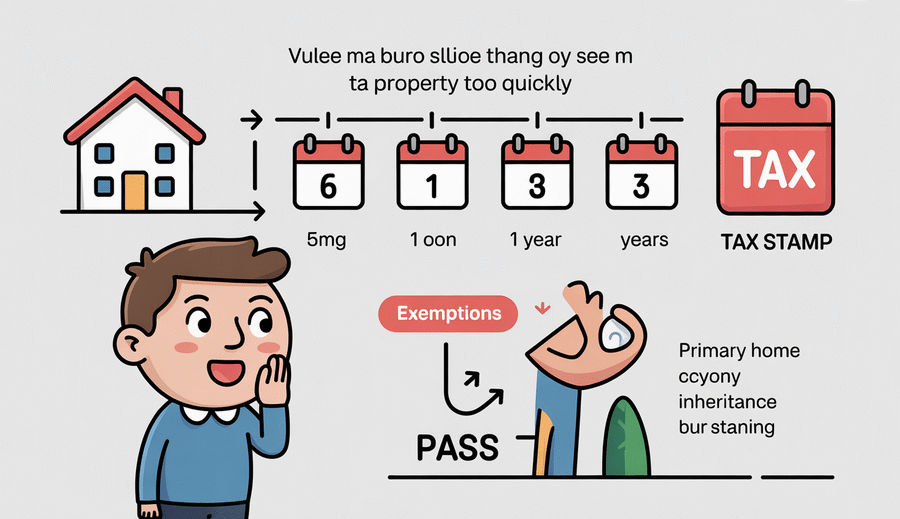

The primary triggers based on timing revolve around three key periods post-acquisition. Disposing of a property within the initial six months incurs the highest SSD rate. Selling between six months and twelve months triggers a lower, yet still significant, rate. A third trigger point applies to disposals occurring between twelve months and thirty-six months, attracting a further reduced rate compared to the shorter periods. Generally, residential property held for longer than thirty-six months is exempt from SSD based solely on the holding period criterion.

Beyond simple adherence to timelines, SSD liability can also arise from more intricate arrangements seemingly designed to circumvent the duty. Authorities rigorously scrutinize linked transactions where a sequence of disposals might effectively constitute a short-term resale of a property interest. Similarly, the use of nominee arrangements, where legal ownership rests with one party while beneficial ownership lies with another, can trigger SSD if the beneficial interest changes hands within the prohibited holding period, particularly if the arrangement appears intended for tax avoidance. While SSD primarily targets residential properties to curb housing market speculation, its scope is specific; non-residential properties generally fall outside these particular SSD triggers.

A simplified overview of the primary holding period triggers for SSD is provided below:

| Holding Period | SSD Implication |

|---|---|

| 0 to 6 months | Highest SSD rate triggered |

| > 6 months to 12 months | Moderate SSD rate triggered |

| > 12 months to 36 months | Lower SSD rate triggered |

| > 36 months | Generally no SSD based on holding period |

Maintaining awareness of these critical triggers, encompassing both the explicit timeline requirements and the more subtle anti-avoidance provisions, is essential for navigating property transactions in Hong Kong and accurately assessing potential stamp duty obligations.

Full Exemptions for Primary Residences Under SSD

A significant relief mechanism within Hong Kong’s Special Stamp Duty (SSD) framework is the exemption granted for the sale of a property that genuinely served as the owner’s sole or primary residence. This provision aims to protect genuine homeowners who need to sell due to unforeseen life events, clearly distinguishing them from the short-term speculators targeted by the SSD. Understanding the specific criteria and conditions for this exemption is vital for assessing potential tax liabilities.

One key condition for qualifying for this exemption involves sales necessitated by certain hardship events. Owners may be eligible for an exemption if they sell their primary residence within a specific timeframe, typically six months, following events such as the death of the owner or a close relative residing with them, the owner or a family member suffering a critical illness requiring substantial medical expenditure, or the owner emigrating from Hong Kong. Crucially, the property must have been the owner’s sole or primary residence immediately preceding the qualifying event for this specific relief to apply.

To successfully claim the primary residence exemption, the owner must provide compelling evidence to the Stamp Office demonstrating that the property in question genuinely served as their main home. This usually necessitates submitting documentation that substantiates continuous occupation and strong ties to the address. Examples of acceptable evidence include utility bills, bank statements, correspondence from government departments, residential addresses listed on identity documents, and potentially tax records. Clearly establishing a pattern of residency at the property is fundamental to substantiating the claim.

The situation becomes more intricate when an individual owns multiple properties. While the exemption applies specifically to the *primary* residence, owning another property does not automatically preclude a claim for the property being sold. However, the owner bears a higher burden of proof to unequivocally demonstrate which property truly constituted their main home. Factors considered may include where the owner and their family principally reside, where children attend school, the location where the owner conducts their daily life, and the length of time spent at each property. The exemption applies strictly to the single property that the Stamp Office accepts as the primary residence based on the totality of the evidence provided.

Partial Exemptions for Corporate Restructuring Under SSD

Beyond the exemptions available for primary residences, Hong Kong’s Special Stamp Duty framework also incorporates provisions for relief in specific corporate restructuring scenarios. These acknowledgements reflect the understanding that genuine business reorganizations should not face undue penalties from taxes designed primarily to curb individual short-term property speculation. While these are typically partial exemptions rather than full waivers like some personal reliefs, they offer crucial flexibility for businesses managing asset portfolios and group structures.

A significant area covered involves intra-group transfers. A partial exemption may be applicable when a property is transferred between companies belonging to the same corporate group. Stringent conditions typically apply, requiring a clear relationship, such as one entity being a subsidiary of the other or both being under common control by a parent company. The transfer must be demonstrably for the purpose of legitimate group restructuring, reorganization, or rationalization, rather than primarily aimed at avoiding SSD. Providing clear proof of the group relationship and the underlying business rationale is essential to qualify for this relief.

Furthermore, meticulous documentation is critical in scenarios involving share-for-property swaps within a group structure. When property assets are exchanged for shares as an integral part of a bona fide restructuring, comprehensive documentation is mandatory to substantiate the transaction. This includes corporate resolutions approving the restructuring, detailed agreements outlining the share exchange and property transfer terms, and clear evidence demonstrating that the transaction is a necessary component of a broader, legitimate corporate objective. Meticulous record-keeping is paramount for the successful application of this exemption.

It is crucial to understand that receiving a property under these partial corporate exemptions often entails restrictions on subsequent disposals. If the recipient company were to sell the property to an external party within the standard SSD holding periods (6, 12, or 36 months measured from the initial intra-group transfer date), the benefit of the partial exemption might be subject to clawback, or the subsequent disposal could trigger SSD liability. These measures are in place to prevent companies from utilizing restructuring provisions as a loophole for engaging in short-term speculative property trading without incurring the intended duty.

Special Considerations: Divorce and Inheritance Under SSD

While the Special Stamp Duty (SSD) framework in Hong Kong is primarily designed to target speculative short-term property transactions, specific life events such as divorce and inheritance introduce unique scenarios with tailored considerations. Understanding how SSD applies in these sensitive contexts is crucial for individuals navigating these often complex transitions. Property transfers that occur between spouses pursuant to a court order or a legally binding separation agreement reached in the context of divorce proceedings are typically treated distinctly under SSD rules. These transfers are often exempt, recognizing that they represent mandated divisions of matrimonial assets rather than voluntary market transactions driven by speculative intent. Proper documentation of the court order or separation agreement is essential to support such an exemption claim.

When a property is acquired through inheritance, the application of SSD rules differs from properties acquired via outright purchase. The act of inheriting the property itself does not trigger SSD liability. However, if the beneficiary subsequently decides to sell the inherited property, the sale may be subject to SSD depending on the holding period. For SSD purposes, the holding period clock generally starts from the date the beneficiary legally acquired the property through inheritance, not the date the deceased originally purchased it. Therefore, reselling the inherited property within the standard SSD holding periods (e.g., 6, 12, or 36 months from the date of inheritance) could potentially attract the duty.

Furthermore, clarity surrounding beneficiary nominations and the formal legal transfer of ownership upon death is vital for SSD assessment. The individual who ultimately inherits the property and becomes the legal owner is responsible for any potential SSD liability if they choose to sell within the prescribed period. Ensuring that all required documentation pertaining to the inheritance process, such as the grant of probate or letters of administration and the subsequent property transfer deeds, is correctly executed and recorded is necessary to establish the accurate start date of the holding period for the beneficiary and to correctly assess any future SSD implications upon resale.

Key Regulatory Changes and Implications (Post-2023)

Hong Kong’s regulatory landscape governing the Special Stamp Duty (SSD) has undergone significant adjustments, notably with changes introduced from late 2023. These revisions were primarily aimed at reinforcing the duty’s effectiveness in deterring speculative activities and have introduced a new layer of complexity for property owners and investors, signaling the authorities’ strong commitment to maintaining stability in the property market. Understanding these updates is critical for ensuring compliance and avoiding potential pitfalls.

A central focus of the recent revisions has been the implementation of tightened anti-avoidance measures. These provisions are specifically designed to close loopholes that individuals or entities may have previously exploited to circumvent SSD liability. The updated regulations subject complex transaction structures and nominee arrangements to more rigorous scrutiny, making it more challenging to disguise short-term property disposals. Property owners must now demonstrate clearer intent and legitimate purpose behind their transactions to satisfy the authorities that the sale or transfer is not primarily motivated by SSD avoidance. This increased scrutiny necessitates meticulous record-keeping and greater transparency in dealings.

Furthermore, recent changes have notably expanded the audit powers granted to the tax authorities regarding SSD compliance. Inspectors are now equipped with broader capabilities to investigate potentially suspicious transactions, demand extensive documentation, and conduct more in-depth inquiries into property ownership histories and transaction timelines. This heightened oversight means property owners should be prepared for greater scrutiny and ensure all relevant documents related to property acquisition and disposal are readily available, accurate, and complete. The emphasis has shifted towards proactive compliance rather than a reactive stance against potential inquiries.

Coupled with expanded audit powers, the penalty structures for non-compliance with SSD regulations have also been reviewed and updated. While specific penalty rates can vary based on the nature and severity of the violation, the general trend indicates potentially higher financial consequences for failures ranging from late payment to deliberate evasion. The revised framework aims to serve as a stronger deterrent against non-compliance, underscoring the paramount importance of timely and accurate declaration and payment of SSD whenever applicable. Collectively, these changes signify a stricter enforcement environment for SSD in Hong Kong, demanding diligent adherence from all property market stakeholders.

Strategic Timing for SSD Mitigation

Navigating Hong Kong’s Special Stamp Duty (SSD) framework involves more than simply understanding the regulations; strategic timing is a paramount consideration for mitigating potential tax liabilities. For property owners contemplating disposal, carefully planning the sale date can profoundly impact whether SSD is triggered and, if so, at which rate. This section explores how optimizing the timing of your property transaction can be a powerful tool in effectively managing your SSD exposure.

A fundamental aspect of strategic timing involves aligning your intended sale date with the defined SSD holding period thresholds. Hong Kong’s SSD is levied based on the duration a property has been held, offering significant rate reductions or complete exemption for longer holding periods (exceeding 6 months, 12 months, and ultimately 36 months). Prudent planning requires a keen awareness of these specific thresholds. By aiming for a disposal date that falls just outside a relevant holding period boundary, you can potentially avoid SSD entirely or qualify for a lower tax bracket. This approach requires forward-looking market assessment to determine if waiting slightly longer for the SSD period to expire is financially sound, balancing potential market fluctuations against a guaranteed tax saving.

While SSD is a transaction-specific tax, coordinating major financial events like property sales with broader personal financial planning cycles can offer indirect benefits. Ensuring all necessary documentation is in order well in advance of key administrative deadlines, such as those preceding the end of a tax year, can prevent last-minute rushes or potential delays in transaction completion that might inadvertently push a disposal date back into an unfavorable SSD holding period. Integrating property disposal planning into a holistic financial strategy allows for better overall tax optimization and liquidity management.

Crucially, strategic timing also means aligning potential disposal dates with specific exemption eligibility criteria. As detailed in previous sections, certain life events or transaction types may qualify for full or partial SSD exemptions, such as transfers following divorce orders, properties acquired through inheritance, or specific intra-group corporate restructurings. In these cases, the timing of the formal transfer deed is critical; it must occur when all conditions required for the specific exemption are met. Careful consultation with legal and tax professionals is essential to ensure that the planned disposal date validly falls within the window or circumstances necessary to qualify for an applicable SSD exemption, thereby preventing unexpected tax burdens.