Time Drain: The Hidden Hours Lost to Manual Tax Filing Manual tax filing often feels......

Hong Kong’s Tax Regime: A Unique Advantage for Investors Hong Kong's tax regime is renowned......

Why Double Taxation Threatens Global Business Growth Operating a business across international borders offers significant......

Hong Kong's Territorial Principle of Taxation Hong Kong employs a territorial basis for taxation, a......

Navigating Short-Term Rental Regulations in Hong Kong Operating properties for short-term stays, defined as less......

Qualifying for Business Expense Deductions in Hong Kong For side hustlers operating in Hong Kong,......

Understanding Hong Kong's Customs Framework Navigating the complexities of international trade requires a firm grasp......

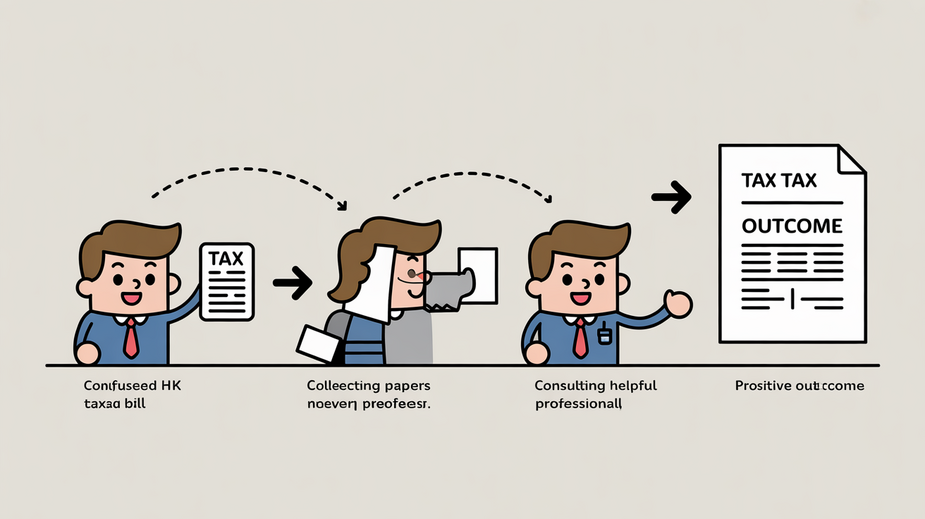

Navigating Your Salaries Tax Assessment Notice Receiving your Salaries Tax Assessment notice from the Hong......

Hong Kong’s Stamp Duty Relief Explained Hong Kong levies stamp duty on specific transactions, primarily......

Understanding Hong Kong's Tax Appeal Framework Navigating a disagreement with the Hong Kong Inland Revenue......

Understanding Hong Kong’s Property Rate System Hong Kong’s property rate system constitutes a fundamental element......

Understanding Hong Kong Profits Tax Assessments Receiving a profits tax assessment from the Inland Revenue......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308