Understanding Hong Kong's Buyer's Stamp Duty (BSD) Buyer's Stamp Duty (BSD) is a significant transaction......

The Challenges Facing Traditional Tax Compliance in Hong Kong Navigating the complex landscape of tax......

Initial Tax Obligations: Rent vs. Sale of Hong Kong Property Choosing whether to rent out......

Why Tax-Exempt Bonds Matter for Family Offices For family offices tasked with preserving and growing......

Hong Kong's E-Commerce Boom and Transfer Pricing Significance Hong Kong is experiencing a remarkable surge......

Understanding Hong Kong's eTAX Ecosystem Navigating tax obligations in Hong Kong relies heavily on the......

The Growing Imperative of Transfer Pricing Compliance The global tax landscape is currently defined by......

Common Misconceptions About Offshore Claims For businesses operating internationally through a Hong Kong entity, the......

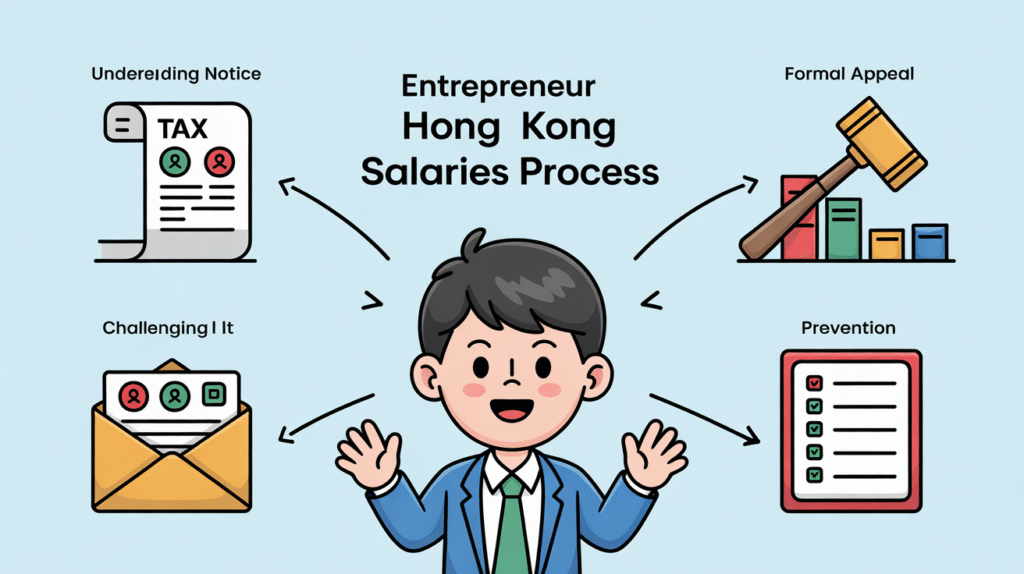

Understanding Your Salaries Tax Assessment Notice Receiving your Hong Kong Salaries Tax assessment notice from......

Hong Kong's Foundational Tax Framework for Compensation Hong Kong operates under a distinct territorial and......

Strengthening Hong Kong-Japan Economic Ties Through a Comprehensive Tax Treaty The economic relationship between Hong......

Hong Kong's Retirement Savings Reality Check Navigating the path to a secure retirement in Hong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308