Understanding Hong Kong Property Tax Obligations Renting out a residential property in Hong Kong entails......

Hong Kong's Inheritance Landscape: Key Advantages and Global Context For entrepreneurs based in Hong Kong,......

📋 Key Facts at a Glance Profits Tax (Two-Tier): 8.25% on first HK$2 million, 16.5%......

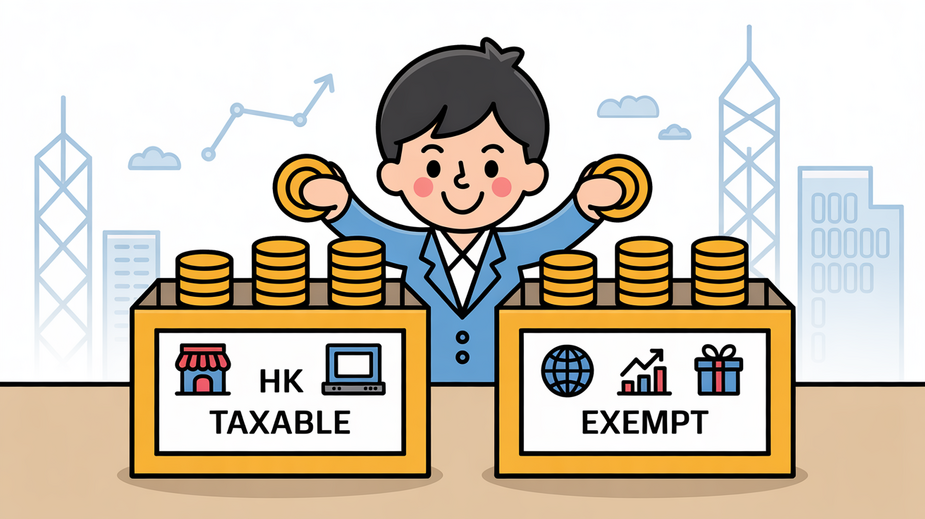

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

Hong Kong Trust Framework for Tax-Efficient Financing The strategic utilization of a Hong Kong trust......

Strategic Role of Tax Structures in Business Expansion Embarking on international expansion presents businesses with......

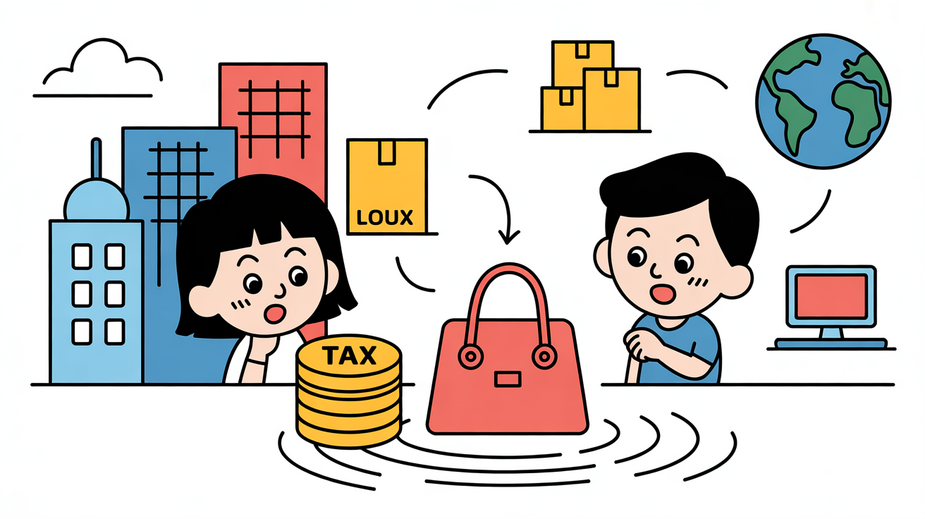

📋 Key Facts at a Glance No Luxury Tax Exists: Hong Kong has NO luxury......

📋 Key Facts at a Glance Standard Property Rates: 5% of rateable value annually Government......

📋 Key Facts at a Glance Property Rates: 5% of Rateable Value (RV) annually Government......

📋 Key Facts at a Glance Territorial Tax System: Only Hong Kong-sourced profits are taxable,......

Why SME Owners Face Unique Retirement Challenges For entrepreneurs and small-to-medium enterprise (SME) owners, navigating......

Hong Kong's Territorial Tax System for E-Commerce Hong Kong operates under a territorial basis of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308