High-Frequency Trading and Hong Kong's Market Landscape High-Frequency Trading (HFT) has become a defining element......

Corporate Tax Structures for SMEs Examining the foundational corporate tax structures reveals significant differences in......

Defining Intellectual Property Income Under Hong Kong Tax Law Understanding the tax implications for income......

Why Proper eTAX Archiving Is Non-Negotiable Maintaining accurate and accessible tax records is a fundamental......

Understanding Hong Kong's Property Tax Framework Navigating property tax obligations is a fundamental requirement for......

Understanding Hong Kong's Territorial Taxation System Hong Kong operates under a distinct territorial basis of......

Understanding Hong Kong's Two-Tiered Profits Tax Structure Hong Kong's profits tax system features a distinct......

Understanding Hybrid Mismatch Arrangements Hybrid mismatch arrangements constitute a significant area of complexity within international......

Understanding Hong Kong Tax Residency for Foreign Entrepreneurs For foreign entrepreneurs operating or residing in......

Understanding Tax Nexus in Hong Kong's Digital Economy For businesses operating internationally, particularly in the......

Decoding the Initial Audit Notification Receiving a tax audit notification from the Inland Revenue Department......

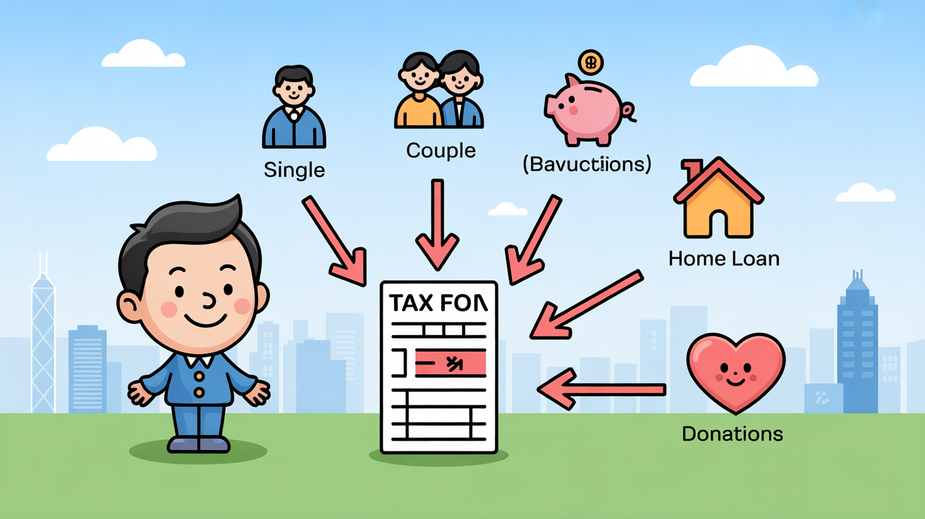

Understanding Personal Allowances in Hong Kong Navigating personal income tax requires a clear understanding of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308