The Digital Tax Shift in Hong Kong Hong Kong's tax administration is undergoing a significant......

Understanding Hong Kong Reserved Powers Trusts A Reserved Powers Trust (RPT) under Hong Kong law......

Hong Kong's Unique Tax Landscape for Investors Hong Kong is renowned for its clear, low-rate......

Understanding Hong Kong's Rental Income Tax Scope In Hong Kong, income earned from letting land......

Global Royalty Income: A Core Component of Modern Business In today's hyper-connected global economy, income......

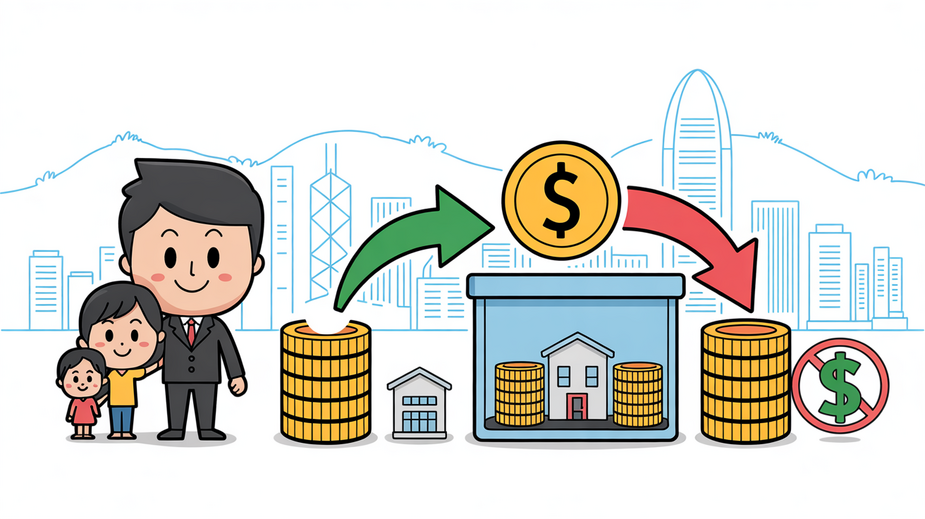

Trust Fundamentals for Wealth Preservation For entrepreneurs in Hong Kong focused on securing their legacy,......

Hong Kong's Territorial Tax System Explained Hong Kong operates a distinct territorial basis of taxation,......

The Strategic Role of Business Structure in Tax Efficiency Choosing the appropriate business structure is......

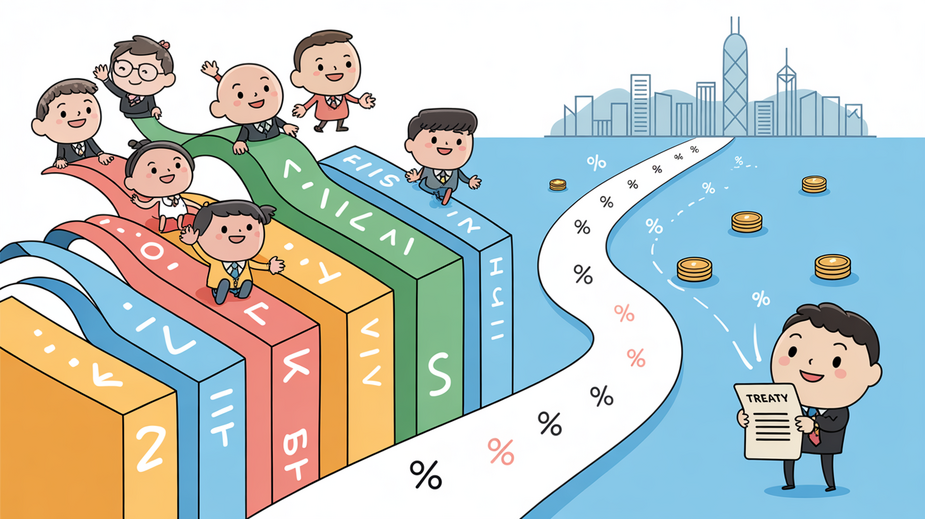

Understanding Hong Kong-China Cross-Border Taxation Operating a business across the distinct tax jurisdictions of Hong......

Hong Kong's Distinctive Unit Trust Environment Hong Kong's strategic location and robust financial infrastructure create......

Overlooked Pitfalls in Estate Distribution Practices Navigating the complex transfer of multi-generational wealth, particularly in......

Understanding Hong Kong's Territorial Taxation System Hong Kong operates under a distinct territorial basis of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308