Understanding Most Favored Nation (MFN) Clauses in Hong Kong Tax Treaties In the complex realm......

Understanding Dutiable Commodities in Hong Kong For any entrepreneur navigating the complexities of Hong Kong's......

Core Legal Obligations for Multiple Income Streams Navigating Salaries Tax in Hong Kong presents specific......

Understanding Hong Kong's eTAX System Essentials Hong Kong's Inland Revenue Department (IRD) offers the eTAX......

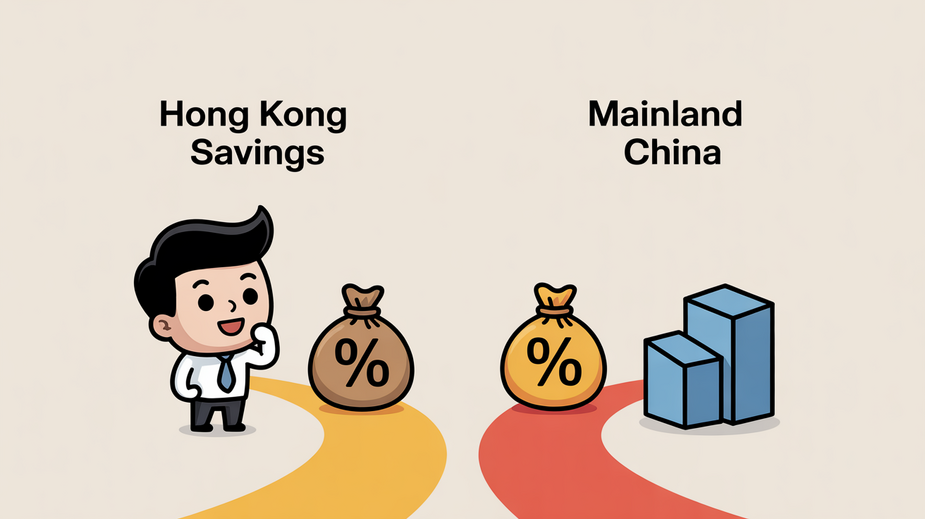

Comparing Core Tax Systems: Territorial vs Progressive Models A fundamental difference distinguishes the tax systems......

Understanding Hong Kong's Stamp Duty Framework Hong Kong imposes stamp duty on specific documents related......

Decoding Double Taxation Dispute Triggers Double taxation in cross-border operations represents a significant challenge for......

Hong Kong's Expanding Gig Workforce Hong Kong's employment landscape has undergone a notable transformation, particularly......

The Challenges Facing Traditional Tax Compliance in Hong Kong Navigating the complex landscape of tax......

Why Family Offices Choose Hong Kong LPFs The landscape of wealth management in Asia is......

How Tax Deductions for Charitable Donations Work in Hong Kong Making charitable contributions can be......

Understanding Temporary and Permanent Employment in Hong Kong Distinguishing between temporary and permanent employment is......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308