Legal Foundations for Audited Financial Statements in Hong Kong In Hong Kong, the requirement for......

Optimizing Hong Kong's eTAX Experience for Expedited Tax Refunds Hong Kong's eTAX system serves as......

Understanding Tax Deductions for Retirement Insurance in Hong Kong Hong Kong's tax framework actively encourages......

Understanding the Core Treaty Framework The comprehensive Double Taxation Arrangement (DTA) established in 2006 between......

Hong Kong Stamp Duty Framework Explained Understanding Hong Kong's stamp duty framework is essential for......

Defining Tax Residency in Hong Kong Understanding your tax residency status is a critical starting......

Hong Kong's Green Economy Shift and Opportunities for SMEs Hong Kong is actively transitioning towards......

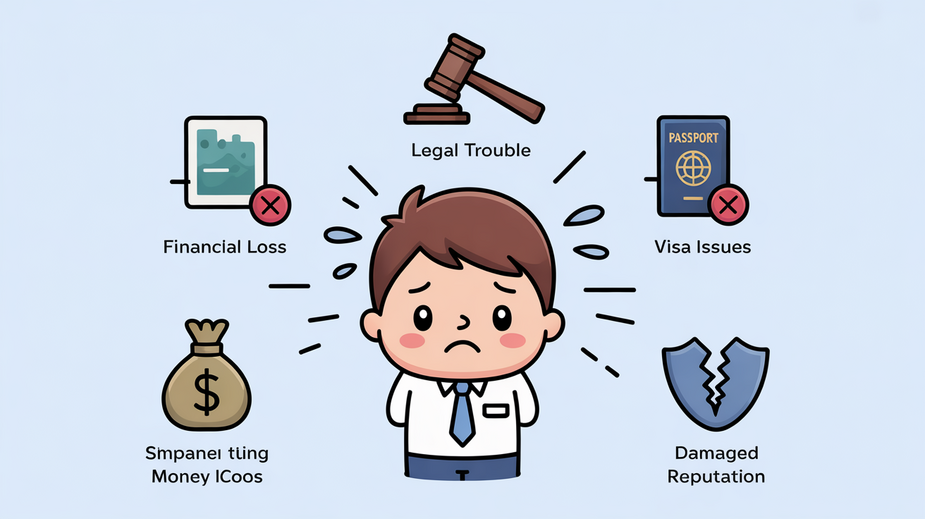

The Critical Risks of Tax Non-Compliance in Hong Kong Navigating the landscape of tax obligations......

Understanding the Hong Kong-France Double Taxation Agreement The Double Taxation Agreement (DTA) between Hong Kong......

Philanthropy as a Tax-Efficient Wealth Strategy Hong Kong presents a compelling environment where the desire......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

Financial Consequences Beyond Direct Fines Navigating tax obligations in a new country presents inherent complexities.......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308