Hong Kong's Unique Tax Landscape for Investors Hong Kong is renowned for its clear, low-rate......

Navigating Short-Term Rental Regulations in Hong Kong Operating properties for short-term stays, defined as less......

Identifying Potential Issues in Hong Kong Tax Assessments Reviewing a tax assessment carefully is a......

Understanding Hong Kong's Tax System Structure Navigating the tax landscape is fundamental for residents and......

The Evolving Global Tax Landscape and its Impact on Hong Kong The international tax system......

Why Traditional Retirement Plans Fall Short for Digital Nomads The conventional approach to retirement planning......

Eligible Charitable Organizations in Hong Kong Understanding which charitable organizations qualify for tax deductions is......

Historical Context and Foundations of Hong Kong's Property Rates Hong Kong's system of property rates......

Navigating Mainland-HK Asset Management Complexities Managing assets that span both Mainland China and Hong Kong......

Maximising Tax Deductions for Hong Kong SMEs: A Guide to Eligible Office and Operational Costs......

Remote Work Revolution Meets Tax Complexity The global professional landscape has been profoundly reshaped by......

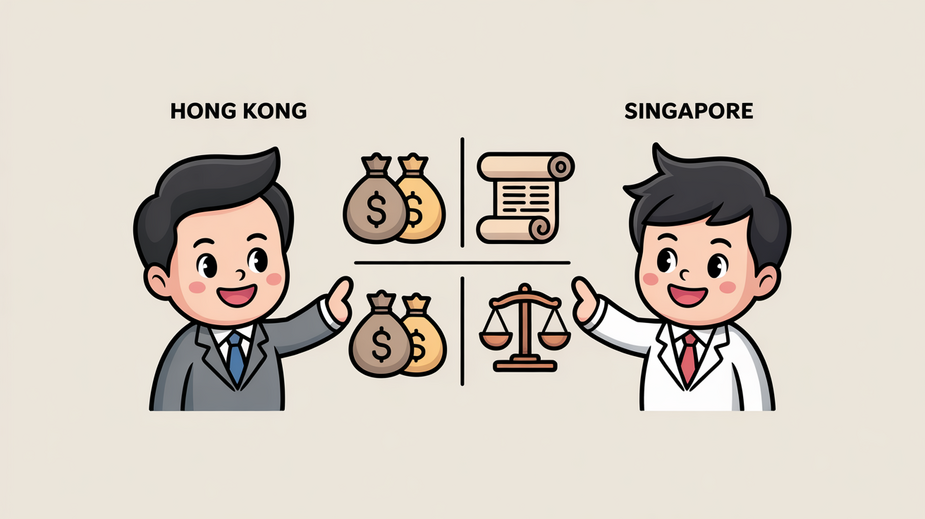

Hong Kong vs. Singapore: Positioning as Global Wealth Hubs Hong Kong and Singapore have long......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308