Understanding Hong Kong's Progressive Two-Tier Profits Tax Hong Kong distinguishes itself with a progressive two-tiered......

Understanding Hong Kong's Property Rate System Navigating property ownership or tenancy in Hong Kong necessitates......

Understanding Cross-Border Dividend Tax Between Hong Kong and Mainland China Navigating the tax implications when......

The Strategic Value of R&D Tax Incentives For small and medium-sized enterprises (SMEs) in Hong......

Why Stamp Duty Knowledge Impacts Business Strategy For businesses operating or planning cross-border expansion, particularly......

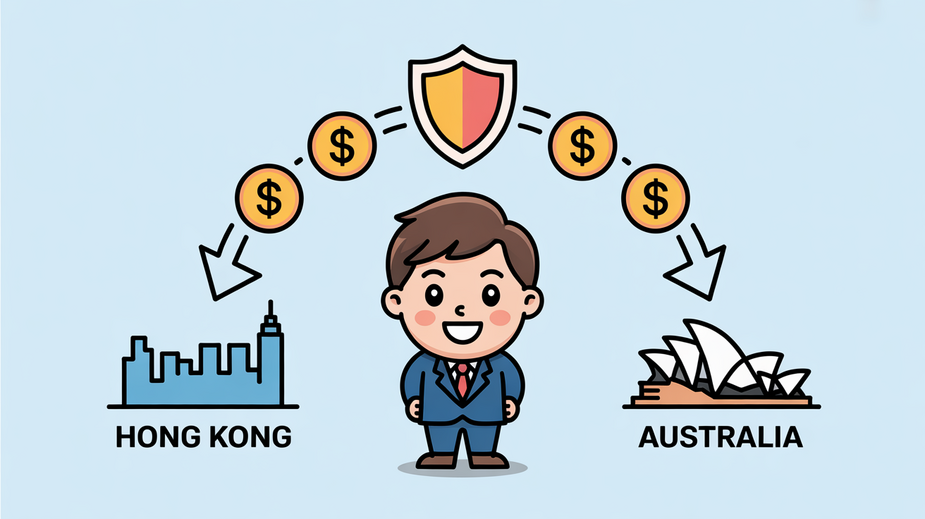

Understanding Double Taxation Pain Points for Expats Navigating the financial landscape when living and working......

Navigating Depreciation Allowances for Mixed-Use Assets in Hong Kong When businesses in Hong Kong seek......

Understanding Hong Kong's Stamp Duty Fundamentals Stamp duty in Hong Kong is a foundational tax......

Current Framework of Excise Duties in Hong Kong Hong Kong operates a specific and focused......

Is Rental Income from Family Taxable in Hong Kong? Under Hong Kong law, income generated......

Understanding Mixed-Use Property Classifications in Hong Kong Mixed-use developments represent a dynamic and increasingly prevalent......

Understanding the HK-Australia DTA Framework The Double Taxation Agreement (DTA) between Hong Kong and Australia......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308