Hong Kong's Evolving Tax Landscape for Tech SMEs Hong Kong has solidified its position as......

📋 Key Facts at a Glance Simplified System: All property buyers now face the same......

📋 Key Facts at a Glance Critical Deadline: You have exactly one month from the......

Understanding Depreciation Allowances for Hong Kong Landlords For property owners in Hong Kong who rent......

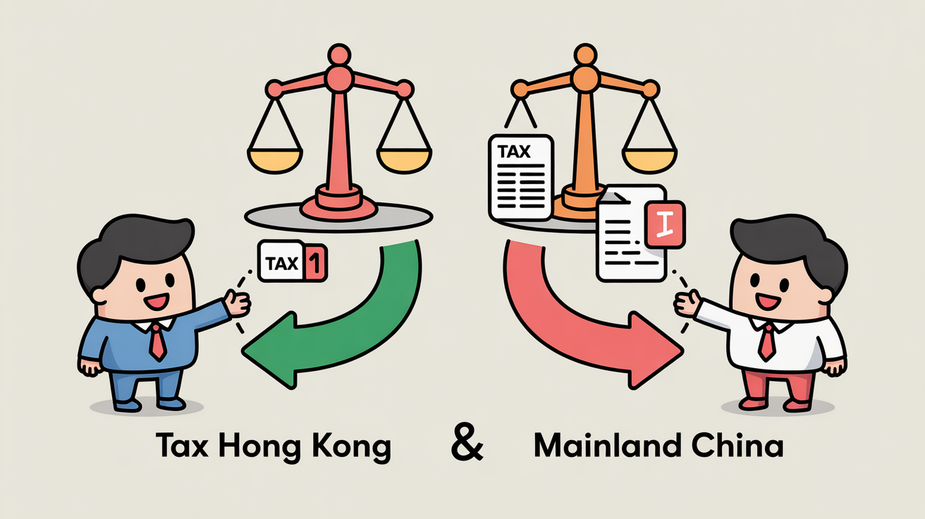

📋 Key Facts at a Glance Territorial System: Hong Kong taxes only income sourced in......

📋 Key Facts at a Glance Hong Kong System: Independent Board of Review tribunal under......

Defining Vacant Units Under Hong Kong Law Understanding the official definition of a vacant unit......

Understanding Hong Kong's Favorable Tax Landscape Hong Kong is widely recognised for operating one of......

Understanding Property Tax on Rental Income in Hong Kong Property owners generating rental income from......

📋 Key Facts at a Glance Strict Deadlines: You must file objections within 1 month......

📋 Key Facts at a Glance Hong Kong's Territorial Tax System: Only Hong Kong-sourced profits......

📋 Key Facts at a Glance Digital Transformation: Three new eTAX portals launched July 2025,......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308