Understanding Hong Kong's Territorial Tax System A foundational element for any business contemplating incorporation in......

Navigating Hong Kong's Distinctive Tax System: A Guide for Foreign Entrepreneurs Hong Kong operates under......

Hong Kong's Tax Landscape for Business Sales For any business owner in Hong Kong contemplating......

Navigating the complexities of compensation in Hong Kong requires a clear understanding of how different......

Hong Kong's Green Economy Shift and Opportunities for SMEs Hong Kong is actively transitioning towards......

Why Profits Tax Compliance Impacts Firm Sustainability For professional services firms operating in Hong Kong,......

Understanding Double Taxation Treaty Fundamentals in Hong Kong Double Taxation Treaties (DTTs), known in Hong......

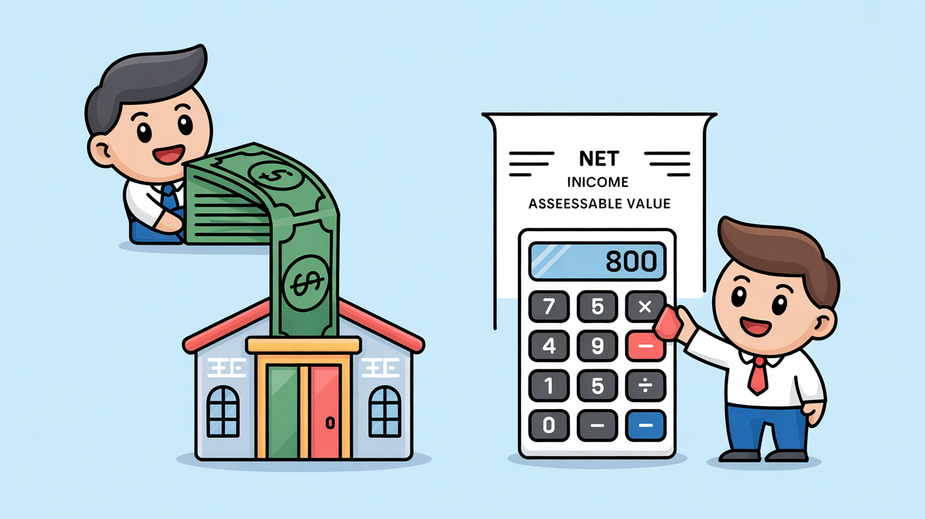

Understanding Net Assessable Value (NAV) Basics In Hong Kong, the Net Assessable Value (NAV) is......

Understanding Tax Deferral Fundamentals Navigating the complexities of business taxation necessitates a firm grasp of......

Core Concepts: Property Rates vs. Land Premiums Demystified Navigating Hong Kong's property finance landscape necessitates......

Immediate Financial Consequences of Tax Dispute Losses Losing a tax dispute in Hong Kong triggers......

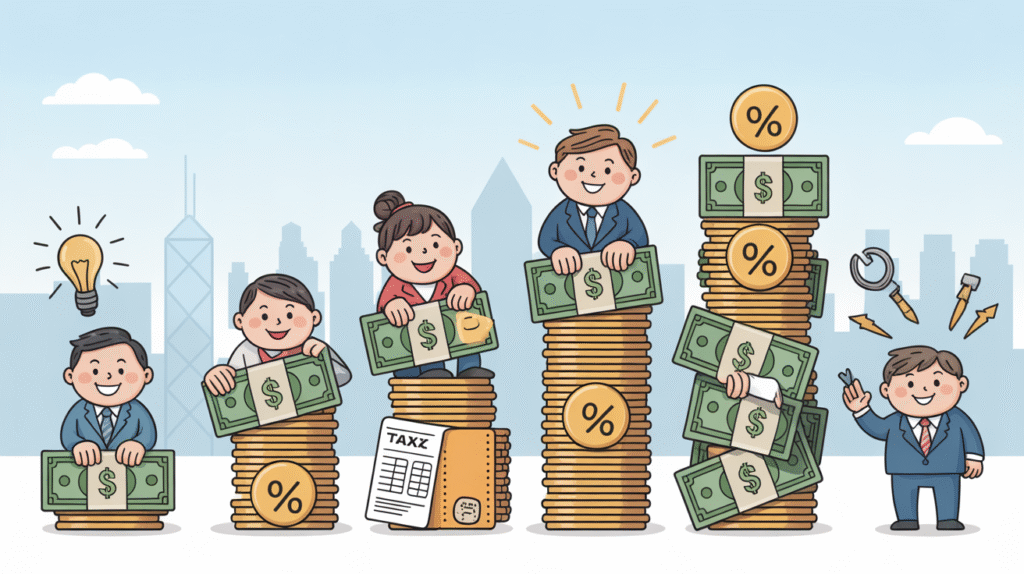

Understanding Hong Kong's Two-Tiered Salaries Tax System Hong Kong employs a distinctive two-tiered system for......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308