Understanding Hong Kong's Two-Tiered Profits Tax Structure Hong Kong's implementation of a two-tiered profits tax......

Historical Context and Foundations of Hong Kong's Property Rates Hong Kong's system of property rates......

Hong Kong's Territorial Tax System Explained Hong Kong operates under a territorial basis of taxation,......

Understanding Triggers for Tax Investigations in Hong Kong Facing an unexpected tax investigation by the......

Understanding Hong Kong’s Land Tenure System Navigating the property landscape in Hong Kong necessitates a......

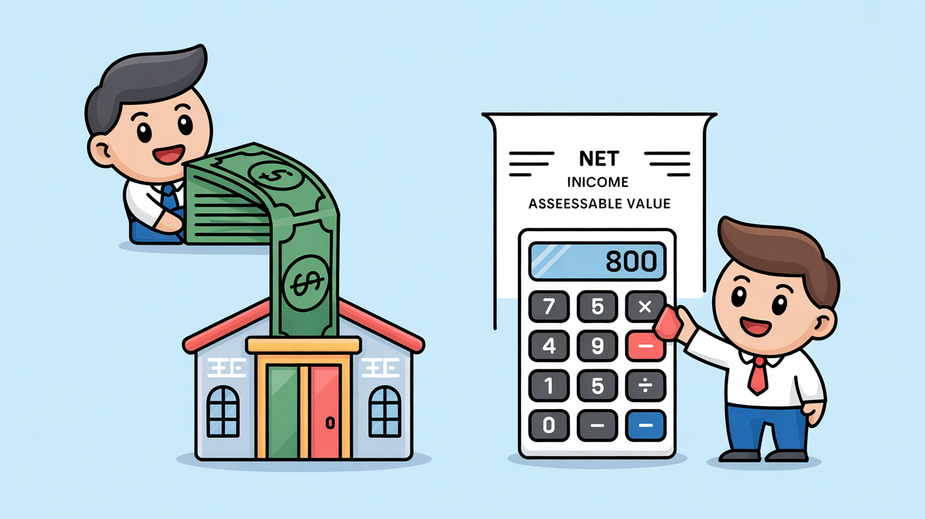

Understanding Net Assessable Value (NAV) Basics In Hong Kong, the Net Assessable Value (NAV) is......

Understanding Customs Duty Fundamentals Customs duties represent a significant, often underestimated, element of the total......

Navigating Mainland-HK Asset Management Complexities Managing assets that span both Mainland China and Hong Kong......

Understanding Eligibility for Tax-Deductible Donations in Hong Kong For Hong Kong-based companies considering charitable contributions,......

Hong Kong Tax: Navigating Residency and Remote Work Understanding your tax obligations is fundamental, particularly......

The Challenges Facing Traditional Tax Compliance in Hong Kong Navigating the complex landscape of tax......

Hong Kong Stamp Duty Fundamentals for Inherited Property In Hong Kong, stamp duty is a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308