Identifying Corporate Tax Audit Triggers in Hong Kong For businesses operating in Hong Kong, understanding......

Foundations of Legal Systems Compared Understanding the fundamental legal systems governing Hong Kong and mainland......

Mandatory vs. Discretionary Employee Benefits in Hong Kong For Hong Kong's small and medium-sized enterprises......

Hong Kong's Evolving Trust Landscape for Global Businesses Hong Kong maintains its prominent position as......

Hong Kong Salaries Tax Fundamentals Understanding the foundational principles of Hong Kong's Salaries Tax system......

Hong Kong’s Distinct Tax Framework for Regional Operations Hong Kong stands as a leading international......

Why Double Taxation Threatens Global Business Growth Operating a business across international borders offers significant......

Understanding Property Management Fees for Hong Kong Rentals Property management fees in Hong Kong represent......

Hong Kong's Tax Framework for M&A Transactions Hong Kong's tax system is fundamentally based on......

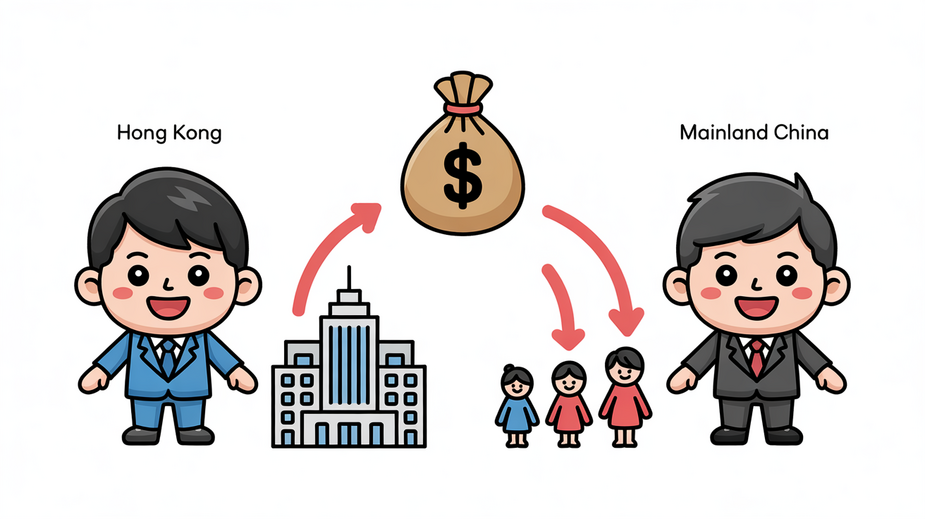

Navigating Transfer Pricing Challenges in Global Operations Multinational enterprises operating through Hong Kong face complex......

Hong Kong Trusts as Cross-Border Wealth Management Tools Hong Kong trusts, built upon robust English......

Historical Context of Hong Kong's Stock Stamp Duty Hong Kong's system for levying stamp duty......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308