Debunking the 'No Tax' Myth for Foreign Workers in Hong Kong A surprisingly prevalent misconception......

Why SME Owners Face Unique Retirement Challenges For entrepreneurs and small-to-medium enterprise (SME) owners, navigating......

Hong Kong’s Unique Tax Framework Explained Hong Kong distinguishes itself globally with a notably straightforward......

Understanding Nominee Property Arrangements in Hong Kong Navigating property acquisitions in Hong Kong often involves......

Eligibility Criteria for Sibling Allowances Navigating tax allowances can significantly impact your annual tax liability......

Understanding Hong Kong Profits Tax Deadlines Navigating the landscape of Hong Kong's taxation necessitates a......

Navigating Hong Kong Tax Disputes Through Mediation Mediation in Hong Kong tax disputes offers a......

Navigating the Cross-Border Tax Challenges for Startups For a burgeoning startup based in the United......

Critical Documentation Red Flags in Audits In the landscape of tax compliance, thorough and accurate......

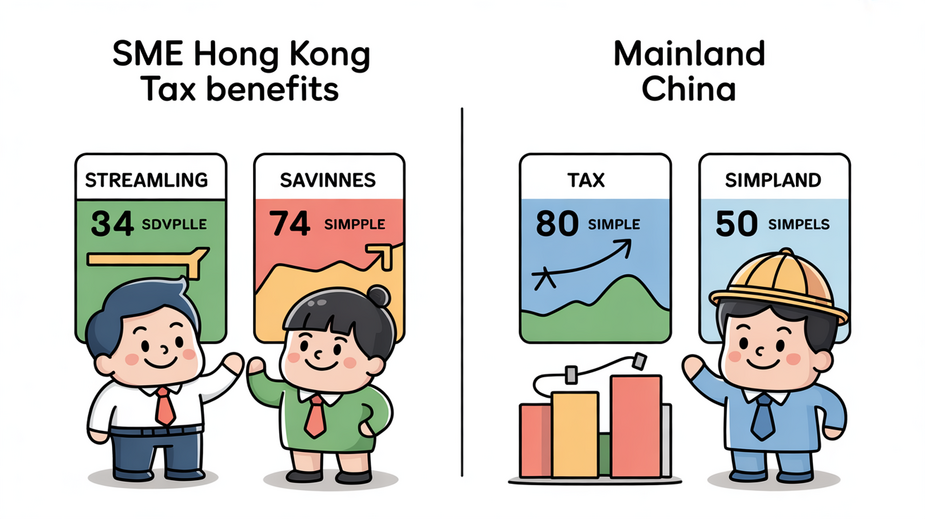

Hong Kong's SME Tax Framework: Key Features Hong Kong presents a highly appealing environment for......

Defining the Arm’s Length Principle in Taxation The Arm's Length Principle (ALP) is a cornerstone......

Core Principles of HK-China Transfer Pricing Rules Effective navigation of the transfer pricing landscape between......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308