Understanding Hong Kong's Stamp Duty Basics Stamp duty constitutes a significant transaction cost within the......

Understanding Capital Allowances in Hong Kong Navigating business finances effectively requires a clear understanding of......

Understanding Income Splitting in Hong Kong Income splitting, as applied within Hong Kong's tax framework,......

Hong Kong's SME Landscape: Economic Cornerstone Small and Medium-sized Enterprises (SMEs) serve as the vital......

Foundations of Legal Systems Compared Understanding the fundamental legal systems governing Hong Kong and mainland......

Evolving Tax Policies in a Digital Economy The accelerating shift towards a digital economy is......

Understanding Why Tax Residency is Crucial for Cross-Border Income Navigating the complexities of earning or......

Understanding Hong Kong's Favorable Tax Landscape Hong Kong is widely recognised for operating one of......

Understanding Hong Kong's Tax Deduction Framework for Charitable Giving Navigating the landscape of tax benefits......

Property Tax Fundamentals in Hong Kong Understanding the foundational principles of Property Tax in Hong......

The Strategic Value of Intellectual Property for Tech Startups In the intensely competitive landscape of......

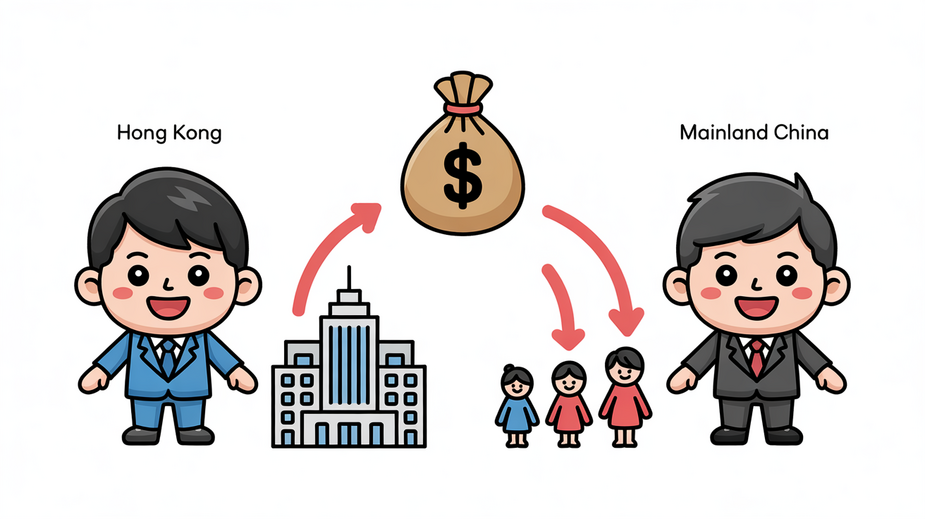

Understanding Hong Kong-China Cross-Border Taxation Operating a business across the distinct tax jurisdictions of Hong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308