Mastering Hong Kong Salaries Tax: A Guide to Avoiding Common Mistakes Navigating the intricacies of......

Why Offshore Claims Attract Scrutiny in Hong Kong Hong Kong operates under a distinct territorial......

Current Trends Driving Hong Kong Tax Reforms Hong Kong's long-standing profits tax system, valued for......

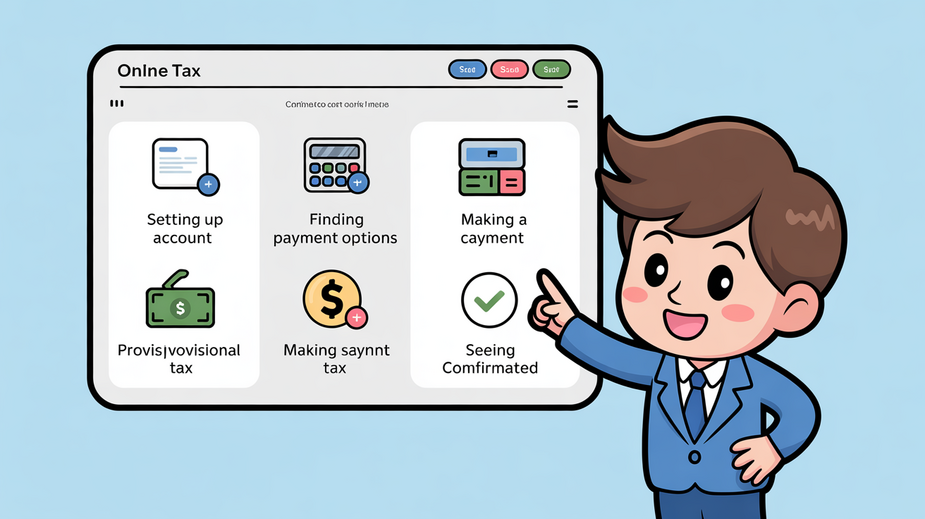

Setting Up Your eTAX Portal Account Effectively managing provisional tax payments through Hong Kong's eTAX......

Core Tax Structures Compared Navigating the landscape of international business assets requires a fundamental understanding......

Hong Kong’s Tax Framework for Trusts and Estates Hong Kong operates under a territorial basis......

Decoding Hong Kong's Safe Harbor Framework for Transfer Pricing In the complex landscape of international......

Navigating the Evolving Landscape of Global Tax Regulations The international tax environment is undergoing continuous......

Stamp Duty Fundamentals in Hong Kong Stamp duty is a fundamental component of transacting shares......

Understanding Investment Income Classification in Hong Kong Navigating the tax landscape for investment income in......

Understanding Hong Kong's Unique Territorial Tax System Hong Kong's enduring prominence as a global financial......

Why Hong Kong Attracts Global Family Offices Hong Kong stands as a premier international financial......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308