Understanding Customs Audit Risks in Hong Kong Businesses operating internationally, particularly through dynamic trade hubs......

Maximizing Tax Savings: Uncovering Deductions for Hong Kong SMEs Many small and medium-sized enterprises in......

Understanding Joint Tax Assessment Basics in Hong Kong In Hong Kong, Salaries Tax is generally......

Offshore Income Classification Basics Understanding the fundamental distinction between offshore and onshore income is crucial......

2023 Stamp Duty Amendments: An Overview The year 2023 marked a significant moment for Hong......

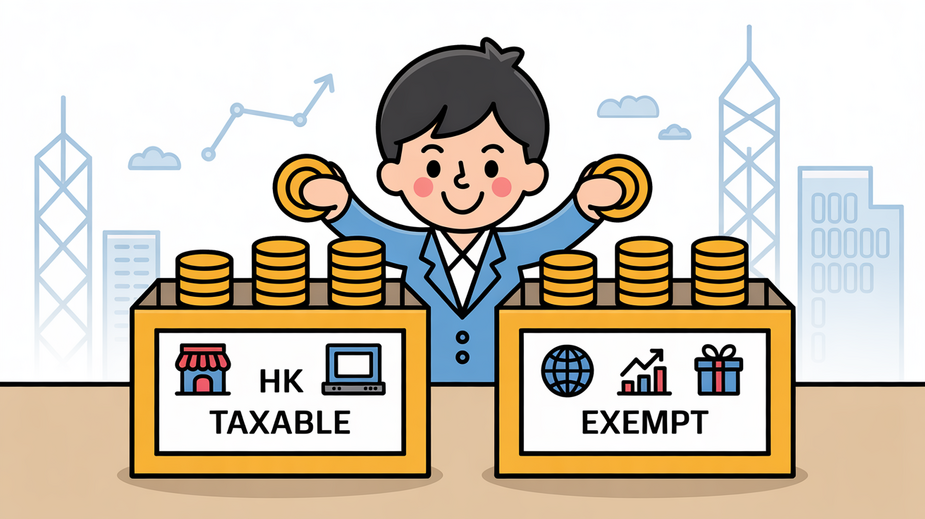

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

Misunderstanding Hong Kong's Territorial Tax Principle One of the most significant and potentially costly errors......

Defining Tax Residency in Hong Kong Understanding your tax residency status is a critical starting......

MPF Withdrawal Tax Fundamentals Explained Navigating the tax implications of Mandatory Provident Fund (MPF) withdrawals......

Understanding Trust Structures in Hong Kong A trust is a fundamental legal arrangement frequently employed......

Understanding Hong Kong Tax Residency for Foreign Entrepreneurs For foreign entrepreneurs operating or residing in......

Why SME Training Investments Pay Double Dividends in Hong Kong For Hong Kong's Small and......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308