Offshore vs. Onshore Business Structures in Hong Kong: A Detailed Guide Understanding the fundamental distinctions......

Understanding Tax Audit Risks in Hong Kong Operating a business in Hong Kong's dynamic environment......

Hong Kong's Strategic Edge for Regional Headquarters Establishing a regional headquarters requires meticulous evaluation of......

Understanding Hong Kong's Tax Digitalization Framework Hong Kong's Inland Revenue Department (IRD) has significantly advanced......

Immediate Financial Consequences of Tax Dispute Losses Losing a tax dispute in Hong Kong triggers......

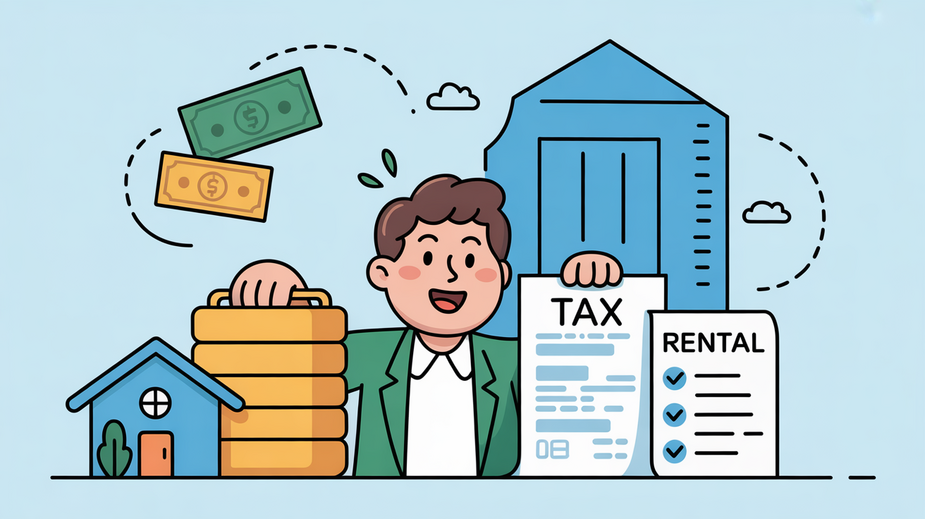

Hong Kong Property Tax Fundamentals for Landlords Understanding the fundamentals of Hong Kong's Property Tax......

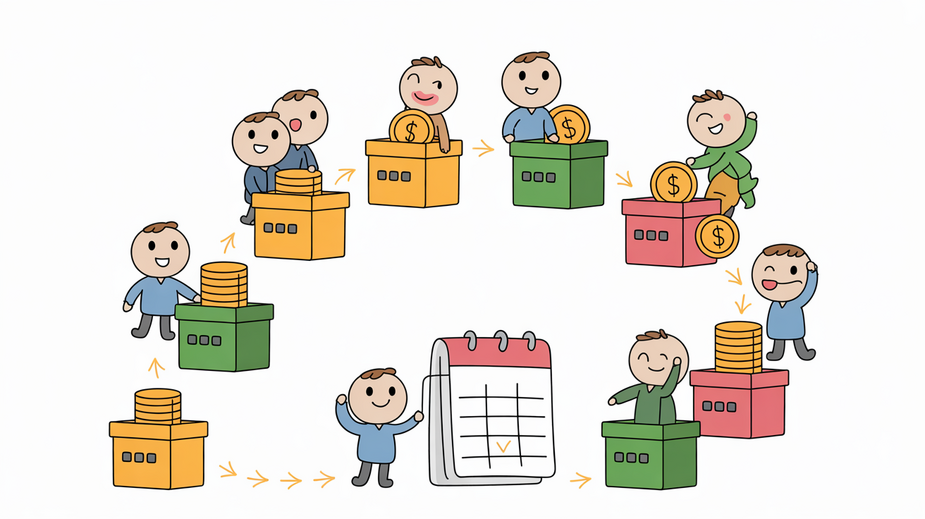

Understanding Hong Kong's MPF Scheme Fundamentals Navigating the Mandatory Provident Fund (MPF) system in Hong......

Corporate Tax Structures for SMEs Examining the foundational corporate tax structures reveals significant differences in......

Understanding Transfer Pricing Fundamentals Transfer pricing is a crucial component of international taxation, specifically governing......

Navigating Hong Kong's Distinctive Tax System: A Guide for Foreign Entrepreneurs Hong Kong operates under......

Understanding Hong Kong Tax Residency for Foreign Entrepreneurs For foreign entrepreneurs operating or residing in......

Hong Kong’s Territorial Tax System and Offshore Exemption A fundamental element underpinning Hong Kong's attractiveness......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308