📋 Key Facts at a Glance Free Port Status: Hong Kong imposes no customs duties......

Understanding Offshore Claims and Their Benefits Navigating Hong Kong's distinctive territorial tax system is crucial......

📋 Key Facts at a Glance Maximum Tax Deduction: HK$60,000 per year for qualifying annuity......

Tax Sparing Credits: Core Concepts Unveiled Tax sparing credits are a fundamental mechanism within international......

Global Tax Policy Shifts Reshaping Hong Kong The international tax landscape is currently undergoing a......

Understanding Hong Kong Salaries Tax Fundamentals Navigating the Hong Kong tax system begins with grasping......

📋 Key Facts at a Glance Tax Advantage: Hong Kong maintains no capital gains tax,......

The Global Challenge of Cross-Border Withholding Taxes Businesses operating across international borders frequently face the......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a unique territorial tax system,......

📋 Key Facts at a Glance Hong Kong Profits Tax: Two-tier system: 8.25% on first......

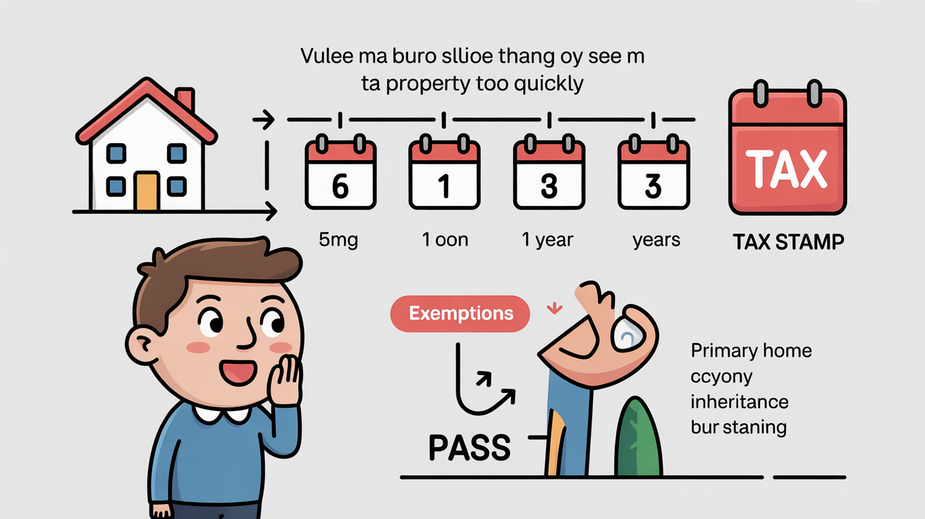

📋 Key Facts at a Glance Complete Abolition: Special Stamp Duty (SSD) was abolished on......

Qualifying Marketing Expenses Defined Understanding which marketing and advertising costs can be legitimately claimed as......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308