Understanding Double Taxation Basics Individuals earning income across international borders, such as expatriates working away......

📋 Key Facts at a Glance Family Office Tax Concession: Hong Kong's FIHV regime offers......

Understanding BEPS Actions 8-10: Aligning Profit with Value Creation The Organisation for Economic Co-operation and......

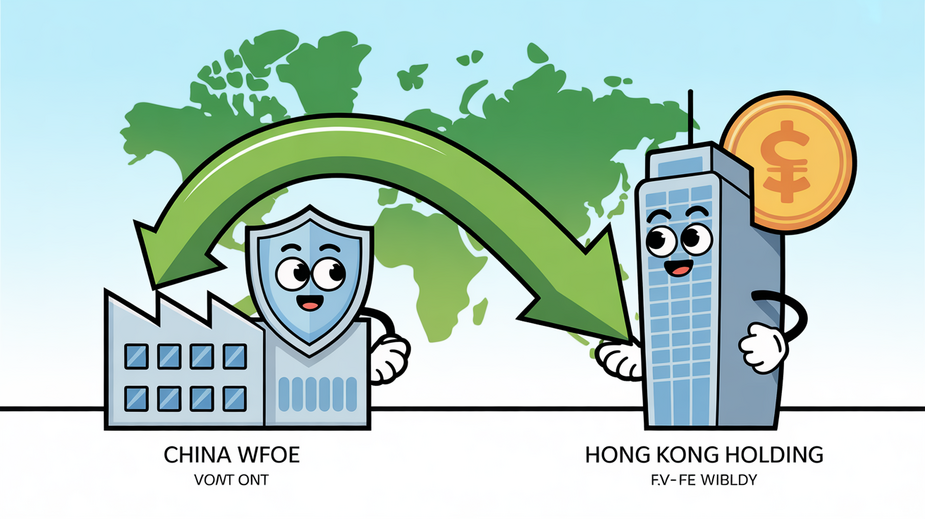

Tax Efficiency Advantages for Cross-Border Profits A fundamental benefit of establishing a Hong Kong holding......

Strategic Advantages of Mainland China Expansion for HK SMEs Expanding operations into Mainland China presents......

Understanding the Core Treaty Framework The comprehensive Double Taxation Arrangement (DTA) established in 2006 between......

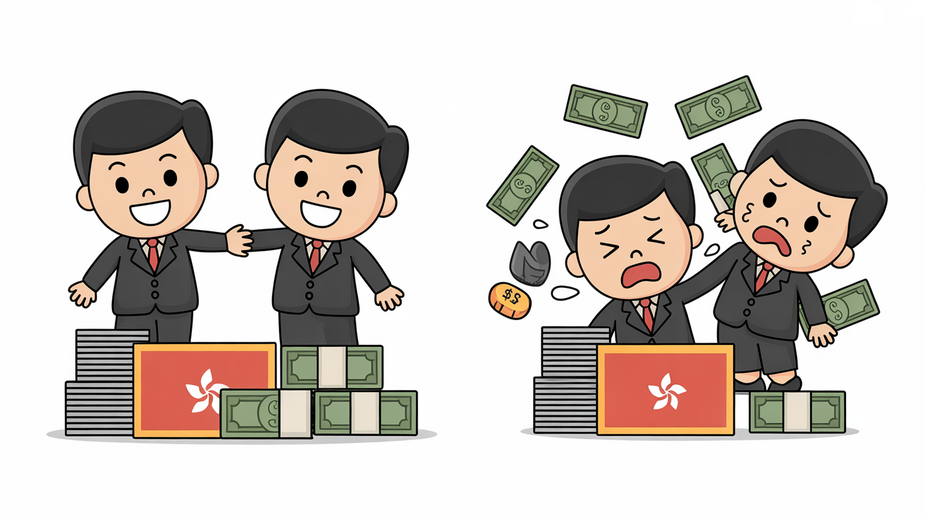

Case Study Breakdown: $2.3M Compliance Failure Real-world examples provide invaluable insights into navigating complex regulatory......

📋 Key Facts at a Glance Tax Deduction: MPF contributions are tax-deductible up to HK$18,000/year......

Understanding Hong Kong's Territorial Basis of Taxation Hong Kong operates under a territorial principle of......

📋 Key Facts at a Glance Tax Classification: Serviced apartments may be subject to Property......

📋 Key Facts at a Glance Hong Kong Stock Transfer: 0.1% per party (0.2% total)......

Strategic Significance of the HK-Netherlands DTA The Double Taxation Agreement (DTA) between Hong Kong and......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308