Growing Cross-Border Retirement Needs in Greater Bay Area The increasing economic integration and professional mobility......

Hong Kong's Evolving Tax Framework: Key Changes Impacting Family Offices Hong Kong has recently implemented......

Understanding Valid Grounds for Stamp Duty Appeals in Hong Kong Successfully appealing a stamp duty......

Qualifying Marketing Expenses Defined Understanding which marketing and advertising costs can be legitimately claimed as......

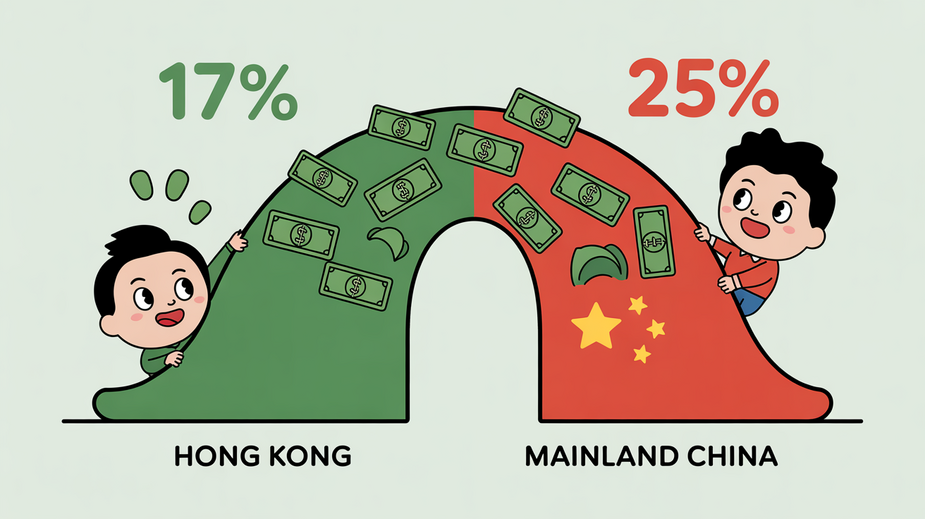

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

Critical Documentation Red Flags in Audits In the landscape of tax compliance, thorough and accurate......

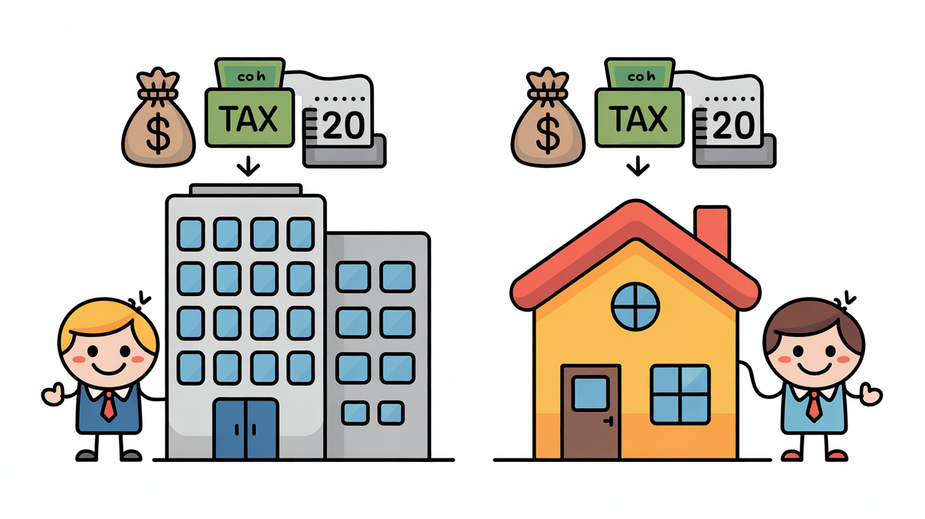

Key Differences in Property Tax Rates Navigating the tax implications of renting out property in......

The Protector Role in Hong Kong Trust Structures: Oversight and Governance Within the sophisticated landscape......

Understanding Hong Kong's Trust Law Framework Navigating the landscape of Hong Kong's trust laws is......

Financial Consequences Beyond Direct Fines Navigating tax obligations in a new country presents inherent complexities.......

Hong Kong's Tax Landscape for Retirement Planning Hong Kong offers a distinct and often advantageous......

Hong Kong’s Tax Environment for Investors Hong Kong's tax system is fundamentally based on the......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308