The BEPS Framework and Its Global Impact on Corporate Taxation The OECD's Base Erosion and......

📋 Key Facts at a Glance Legal Basis: Sections 5B and 7C of the Inland......

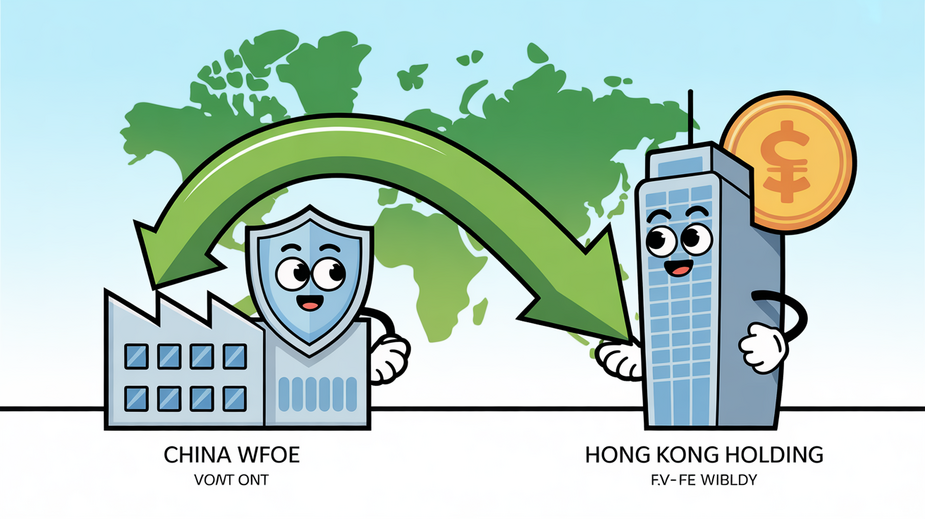

Tax Efficiency Advantages for Cross-Border Profits A fundamental benefit of establishing a Hong Kong holding......

📋 Key Facts at a Glance Hong Kong's Tax Treaty Network: Over 45 comprehensive double......

📋 Key Facts at a Glance Territorial System: Hong Kong has taxed only locally-sourced profits......

📋 Key Facts at a Glance Free Port Status: Hong Kong levies no customs tariffs......

Understanding Hong Kong's Tax System Structure Navigating the tax landscape is fundamental for residents and......

📋 Key Facts at a Glance Estate Duty Abolished: Hong Kong abolished estate duty on......

📋 Key Facts at a Glance Tax Advantage: Hong Kong maintains no capital gains tax,......

📋 Key Facts at a Glance Tax Deduction: MPF contributions are tax-deductible up to HK$18,000/year......

Understanding Hong Kong's Territorial Taxation System Hong Kong operates under a distinct territorial basis of......

📋 Key Facts at a Glance Hong Kong Has No Inheritance Tax: Since 2006, Hong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308