Navigating Hong Kong's Investment Tax Landscape Investing in Hong Kong presents a unique tax environment,......

Navigating Cross-Border Wealth Complexity Managing wealth across the dynamic border between Hong Kong and Mainland......

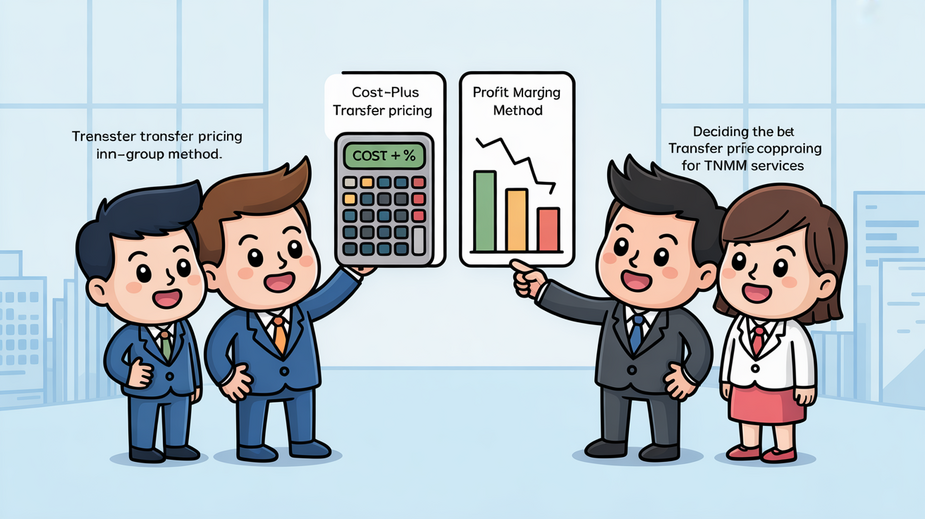

📋 Key Facts at a Glance Legal Basis: Sections 5B and 7C of the Inland......

Hong Kong's Transfer Pricing Framework for Services The foundation of Hong Kong's transfer pricing regulations......

Hong Kong's Territorial Tax System Explained Hong Kong operates under a territorial basis of taxation,......

📋 Key Facts at a Glance No Capital Gains Tax: Hong Kong does not tax......

📋 Key Facts at a Glance Objection Deadline: One month from the date of issue......

Understanding Core Tax Structures When evaluating corporate tax environments, the foundational tax structures of Hong......

📋 Key Facts at a Glance Current Rate: 0.1% each for buyer and seller (0.2%......

Core Mechanics of Hong Kong Limited Partnerships Understanding the foundational structure of a Hong Kong......

📋 Key Facts at a Glance No AD/CVD in Hong Kong: As a free port,......

Navigating Hong Kong's Distinctive Tax System: A Guide for Foreign Entrepreneurs Hong Kong operates under......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308