📋 Key Facts at a Glance Green Bond Tax Exemption: Full profits tax exemption for......

Understanding Hong Kong's Tax Treaty Network for Retirement Planning For individuals strategically planning their retirement......

📋 Key Facts at a Glance No VAT/GST: Hong Kong imposes no Value-Added Tax, Goods......

Navigating Compliance for Overseas Rental Income in Hong Kong For Hong Kong residents, owning and......

Navigating Tax Differences: Hong Kong's Territorial vs. Mainland China's Progressive System Understanding the fundamental differences......

📋 Key Facts at a Glance Global Standard: HS codes are used by over 200......

📋 Key Facts at a Glance Automatic Extension: eTAX filers receive an automatic 1-month filing......

Understanding Offshore Profits in Hong Kong’s Tax System Hong Kong operates a unique tax system......

📋 Key Facts at a Glance Current Stamp Duty Rate: 0.2% total (0.1% buyer +......

📋 Key Facts at a Glance Hong Kong Property Tax: 15% on net assessable value......

📋 Key Facts at a Glance FSIE Phase 1: Effective January 1, 2023, covering foreign-sourced......

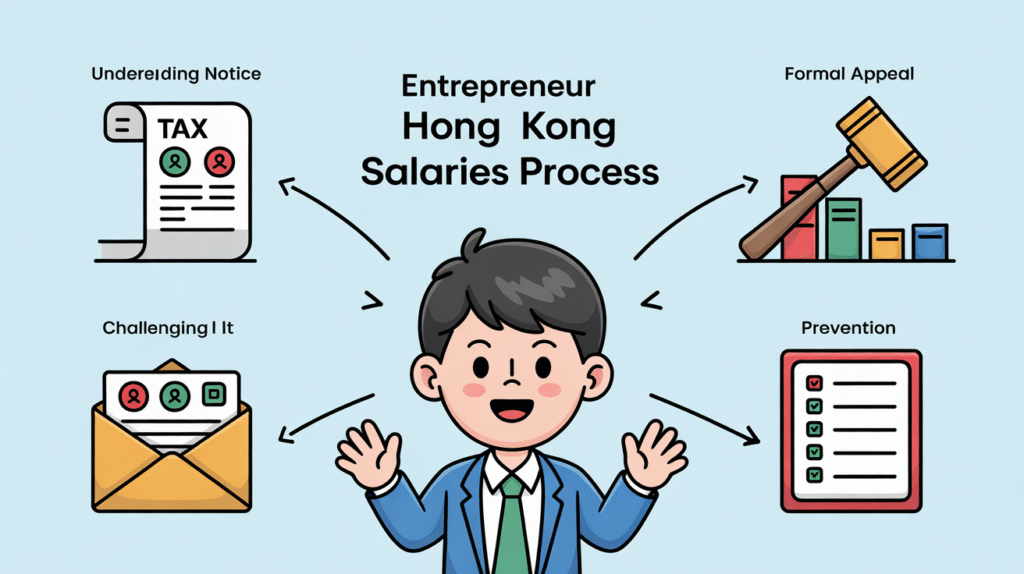

Understanding Your Salaries Tax Assessment Notice Receiving your Hong Kong Salaries Tax assessment notice from......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308