Key Facts: Hong Kong IP Tax Treatment Patent Box Regime: 5% concessionary tax rate on......

Key Facts: Tax Advisors and Audit Risk in Hong Kong Professional Qualifications: Only CPAs (HKICPA)......

Hong Kong's Tax Advantage Landscape Hong Kong is renowned for its business-friendly environment, anchored by......

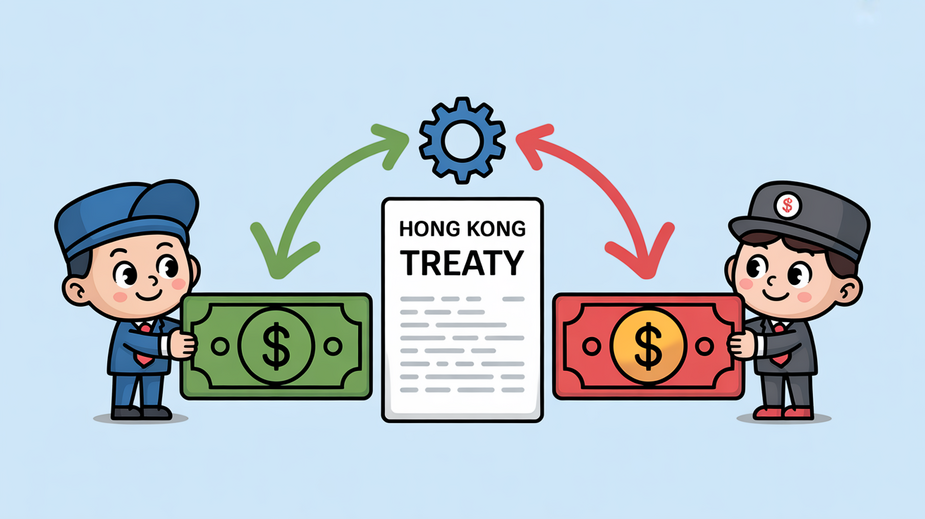

Understanding Transfer Pricing Fundamentals in Hong Kong For multinational enterprises (MNEs) operating across borders, managing......

The Growing Imperative of Transfer Pricing Compliance The global tax landscape is currently defined by......

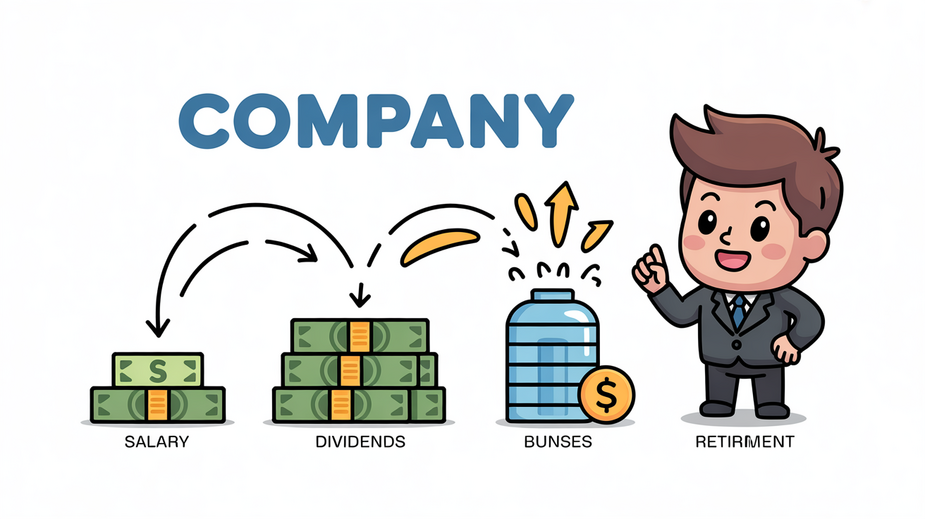

Key Differences: Territorial vs. Worldwide Taxation in Hong Kong and Mainland China When a company......

The Impact of Hong Kong's New Tax Policies on Family Office Investment Structures The Impact......

Hong Kong's Tax Compliance for Family Offices: Structuring Cross-Border Wealth Hong Kong's Tax Compliance for......

The Role of Hong Kong's Tax-Exempt Bonds in Family Office Portfolios The Role of Hong......

Hong Kong Family Office Succession Planning: Tax-Efficient Transfers of Business and Assets Key Facts: Hong......

Key Facts: Stamp Duty and Insider Trading in Hong Kong Current stamp duty rate: 0.1%......

Hong Kong's Tax Fundamentals for Cross-Border Structures Understanding the foundational principles of Hong Kong's tax......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308