Core Principles of Territorial vs. Worldwide Tax Systems Understanding the fundamental differences between territorial and......

Key Facts: Hong Kong Trade Agreements and Customs Duties Free Port Status: Hong Kong maintains......

Understanding Hong Kong's Progressive Tax System Navigating the complexities of Hong Kong's salaries tax is......

Understanding Hong Kong's Education Tax Credit Framework Navigating tax regulations can often seem intricate, yet......

BEPS Impact on Hong Kong’s Tax Framework The OECD's Base Erosion and Profit Shifting (BEPS)......

Understanding Rental Durations and Tax in Hong Kong Navigating Hong Kong's property market as an......

Defining Related-Party Transactions in HK Tax Context Navigating tax compliance in Hong Kong necessitates a......

The BEPS Framework and Its Global Impact on Corporate Taxation The OECD's Base Erosion and......

Understanding Tax Deductions for Retirement Insurance in Hong Kong Hong Kong's tax framework actively encourages......

Understanding Hong Kong's Two-Tier Tax Structure Hong Kong's profits tax system features a distinctive two-tiered......

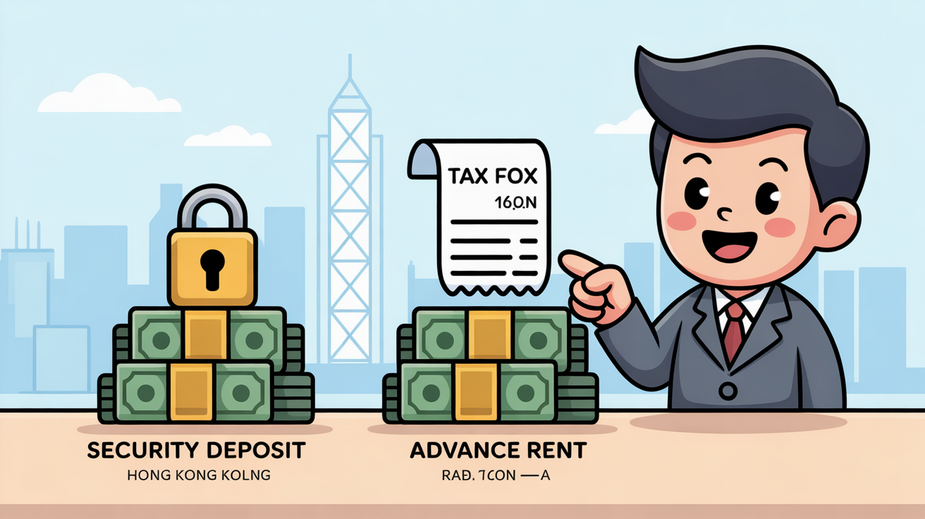

Understanding Security Deposits vs. Advance Rent in Hong Kong Taxation Navigating the tax landscape for......

Key Facts: Hong Kong Stamp Duty on Foreign-Listed Stocks Current Rate: 0.1% each for buyer......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308