Hong Kong’s Tax Framework for Trusts and Estates Hong Kong operates under a territorial basis......

Hong Kong's Territorial Principle of Taxation Hong Kong employs a territorial basis for taxation, a......

Why Currency Volatility Impacts Rental Tax Liability For foreign landlords receiving rental income in a......

Real-Life Case Study: Offshore Income Misreporting Risks A significant real-life case illustrating the potential consequences......

Hong Kong's Profits Tax Framework and Exemption Principles Navigating Hong Kong's profits tax system effectively......

Key Facts: Hong Kong Stamp Duty on Derivatives vs. Equities Current Equity Stamp Duty Rate:......

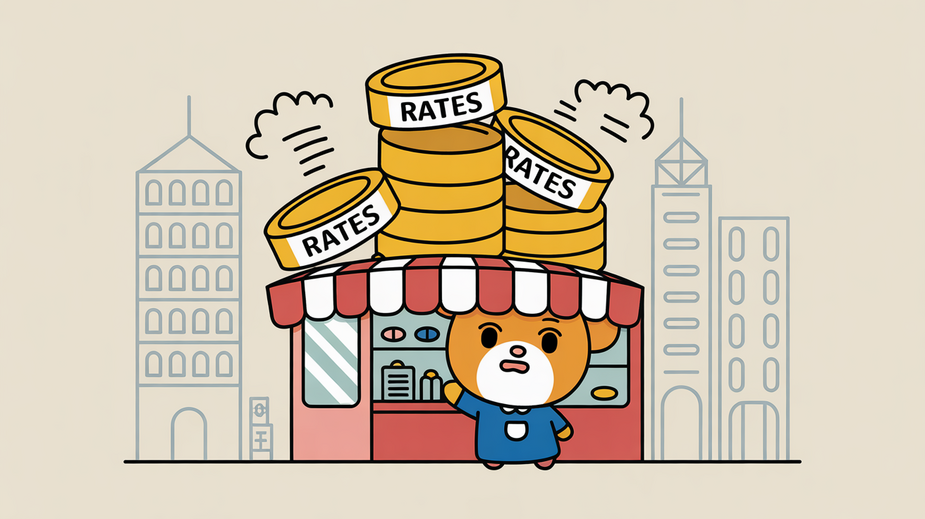

Key Facts: Hong Kong Property Rates for Small Businesses 📊 Rate Percentage 5% of rateable......

Understanding Tax Implications of Marriage in Hong Kong Entering into marriage significantly alters various aspects......

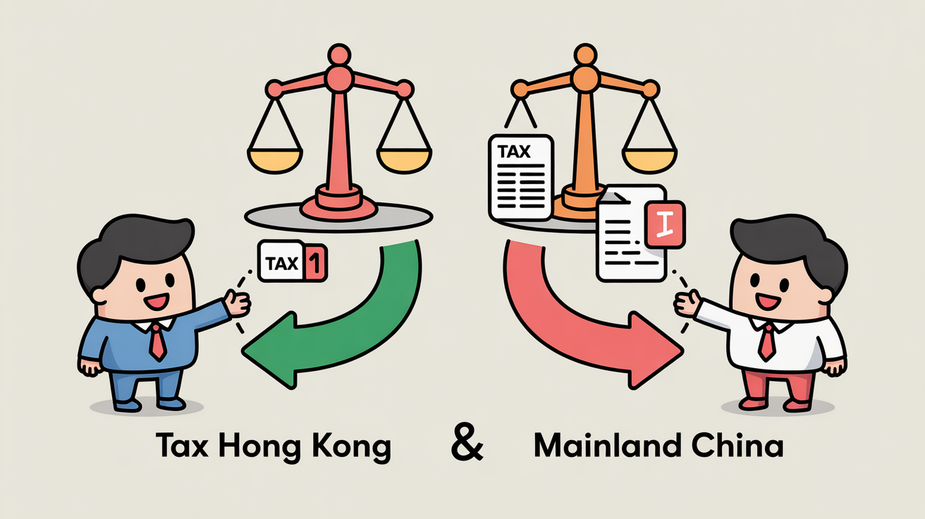

Foundations of Tax Dispute Systems in Hong Kong and Mainland China Understanding the fundamental legal......

Key Facts: Hong Kong Stamp Duty Compliance Filing Deadlines: 2 days for contract notes (Hong......

Decoding the Initial Audit Notification Receiving a tax audit notification from the Inland Revenue Department......

Evaluating Control vs. Responsibility in MPF Management For business owners contemplating a self-managed Mandatory Provident......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308