Understanding Mainland China's Tax Jurisdiction Navigating the tax landscape in Mainland China presents unique challenges......

📋 Key Facts at a Glance Section 80(2): Incorrect returns can result in a HK$10,000......

📋 Key Facts at a Glance Property Rates: 5% flat rate for non-domestic properties; progressive......

📋 Key Facts at a Glance Stock Stamp Duty Rate: 0.1% per party (0.2% total......

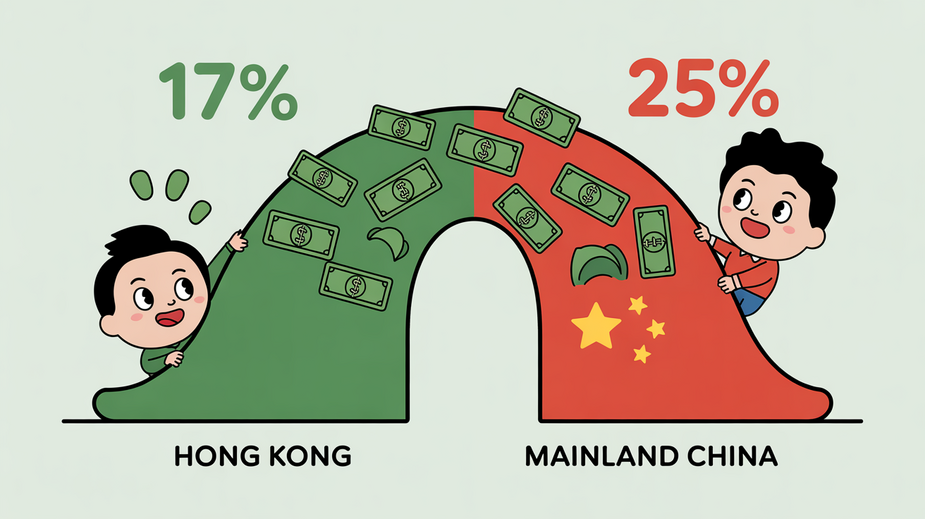

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

📋 Key Facts at a Glance Current Stock Transfer Rate: 0.1% per party (0.2% total)......

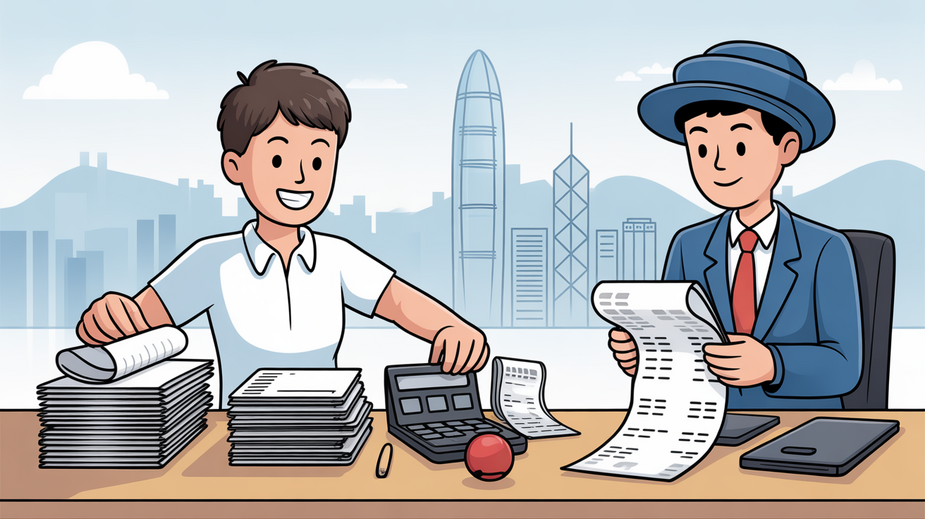

Navigating Hong Kong's Tax Documentation Essentials Understanding and adhering to Hong Kong's tax documentation standards......

📋 Key Facts at a Glance Simplified System: All property buyers now face the same......

📋 Key Facts at a Glance Zero Tax on Fund Profits: Hong Kong's Unified Fund......

BEPS 2.0 and the Two-Pillar Framework Explained The international tax landscape is undergoing a significant......

📋 Key Facts at a Glance Free Port Status: Hong Kong has been a duty-free......

📋 Key Facts at a Glance Property Tax Rate: 15% flat rate on net assessable......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308