Understanding Hong Kong's Territorial Tax Framework Hong Kong distinguishes itself on the global economic stage......

East-West Communication Styles in Tax Negotiations Navigating a tax dispute in a cross-cultural environment like......

Understanding the Hong Kong-US Double Taxation Agreement (DTA) The Double Taxation Agreement (DTA) between Hong......

Understanding Hong Kong's Territorial Tax System One of the most significant advantages of the Hong......

Understanding Depreciation Allowances for Hong Kong Landlords For property owners in Hong Kong who rent......

The Influence of Stamp Duty on Property Valuation and Transactions In Hong Kong, stamp duty......

Understanding Hong Kong's Property Tax Framework Hong Kong's property tax system is a fundamental element......

Hong Kong's Evolving Renewable Energy Landscape in 2024 Hong Kong is increasingly prioritizing renewable energy......

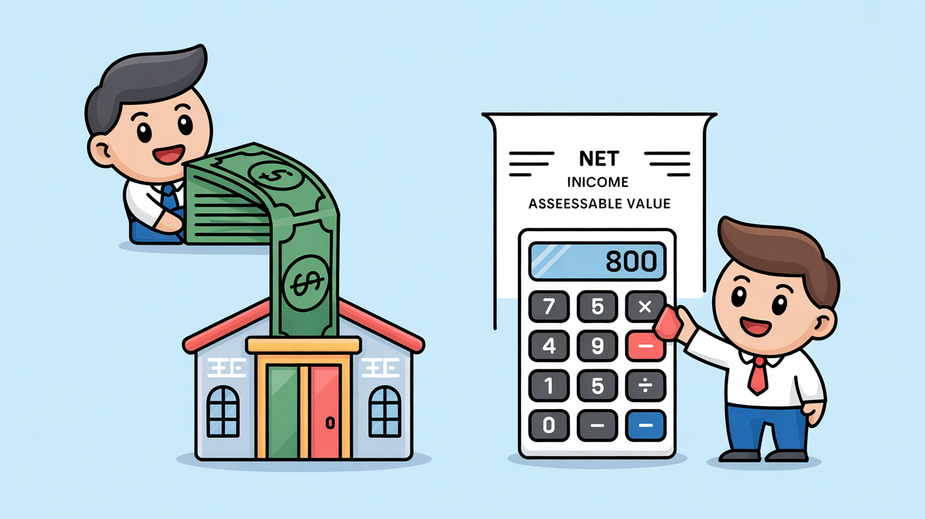

Understanding Net Assessable Value (NAV) Basics In Hong Kong, the Net Assessable Value (NAV) is......

Immediate Steps Following an IRD Query Receiving official correspondence from the Inland Revenue Department (IRD)......

Understanding Eligible Bad Debt for Rent in Hong Kong Navigating the complexities of unpaid rent......

Understanding Hong Kong's Buyer's Stamp Duty (BSD) Buyer's Stamp Duty (BSD) is a significant transaction......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308