Navigating Cross-Border Investment: A Deep Dive into the HK-Singapore DTA The Double Taxation Agreement (DTA)......

Hong Kong's Retirement Savings Challenge Hong Kong, renowned for its economic dynamism, presents a significant......

Hong Kong Trusts as Cross-Border Wealth Management Tools Hong Kong trusts, built upon robust English......

Hong Kong's Distinct Tax Framework for Wealth Preservation Hong Kong distinguishes itself globally with a......

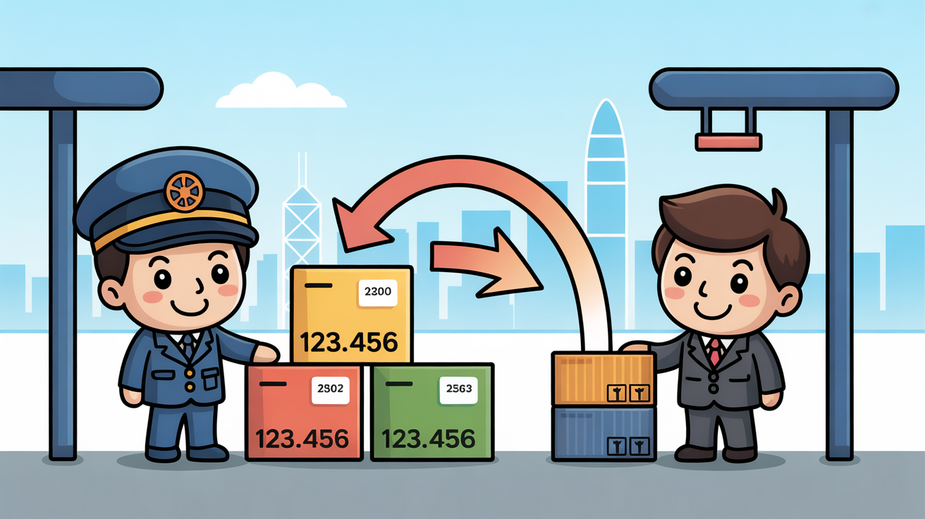

Understanding Hong Kong's Free Port Status Hong Kong's designation as a free port is fundamental......

Understanding Hong Kong's Tax Treaty Network Hong Kong has cultivated a comprehensive network of Double......

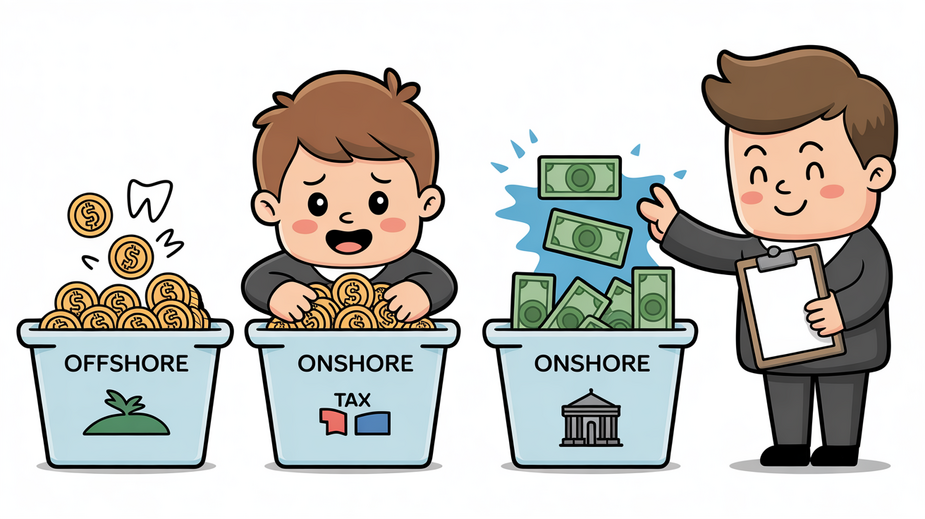

Offshore Income Classification Basics Understanding the fundamental distinction between offshore and onshore income is crucial......

Hong Kong's Inheritance Landscape: Key Advantages and Global Context For entrepreneurs based in Hong Kong,......

Maximizing Tax Benefits: A Guide to Hong Kong's Deduction Framework Navigating Hong Kong's tax landscape......

Remote Work's Impact on Tax Frameworks The rapid global adoption of remote work has introduced......

Understanding Hong Kong Freelancer Tax Fundamentals Navigating the tax obligations as a freelancer or independent......

Understanding HS Codes: A Global Framework for Trade The Harmonized System (HS) stands as a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308