Comparing Mainland and Hong Kong Pension Structures Understanding the fundamental differences between Mainland China's pension......

The Nuances of Hong Kong's Territorial Taxation Principle Hong Kong is often celebrated for its......

Hong Kong's Taxable Compensation Categories In Hong Kong, understanding how various forms of remuneration, particularly......

The Strategic Value of Double Tax Relief in Cross-Border Investment Investing internationally presents compelling opportunities,......

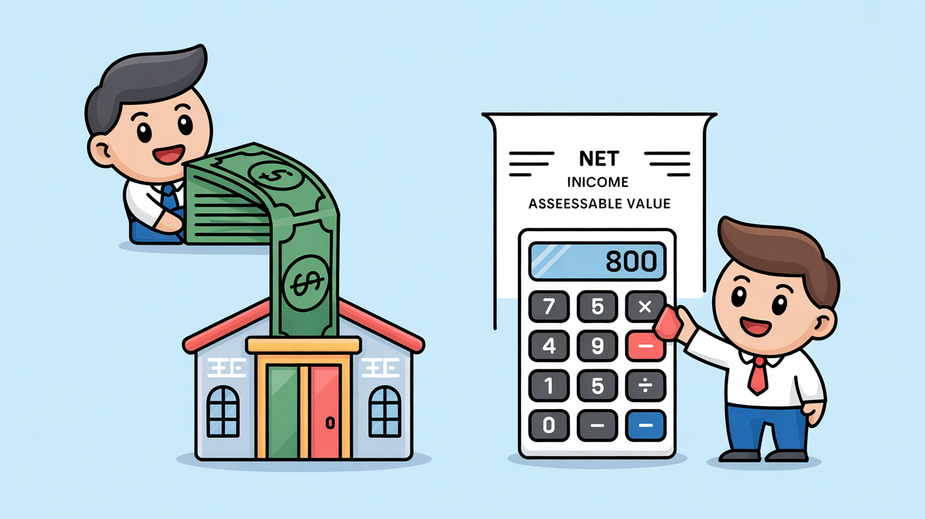

Understanding Hong Kong's Property Tax Framework Navigating property tax obligations is a fundamental requirement for......

Understanding Profits Tax for Hong Kong Joint Ventures Navigating the complexities of profits tax is......

Hong Kong’s Strategic Position in Global Re-Exports Hong Kong holds a prominent position in the......

BEPS Impact on Hong Kong’s Tax Framework The OECD's Base Erosion and Profit Shifting (BEPS)......

Hong Kong's Distinctive Unit Trust Environment Hong Kong's strategic location and robust financial infrastructure create......

Hong Kong's Strategic Tax Position for Wealth Management Hong Kong maintains a prominent position as......

Hong Kong’s Top Tax-Efficient Investment Vehicles for Foreign Entrepreneurs Hong Kong stands as a premier......

Understanding Net Assessable Value (NAV) Basics In Hong Kong, the Net Assessable Value (NAV) is......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308