Hong Kong's Tax Treatment of Cryptocurrency Holdings for Family Offices Key Facts: Cryptocurrency Tax Treatment......

Core Definitions and Tax Scope For business owners navigating Hong Kong's tax landscape, understanding the......

Understanding Eligibility for Elderly Residential Care Expense Claims in Hong Kong Claiming tax deductions for......

Understanding MPF Tax Deduction Fundamentals The Mandatory Provident Fund (MPF) is Hong Kong's compulsory retirement......

Understanding Hong Kong's Stamp Duty Framework Hong Kong's stamp duty system is a foundational element......

📋 Key Facts at a Glance Hong Kong Stock Stamp Duty: 0.1% per party (0.2%......

Hong Kong's Robust Trust Framework for Wealth Defense Hong Kong is recognized as a leading......

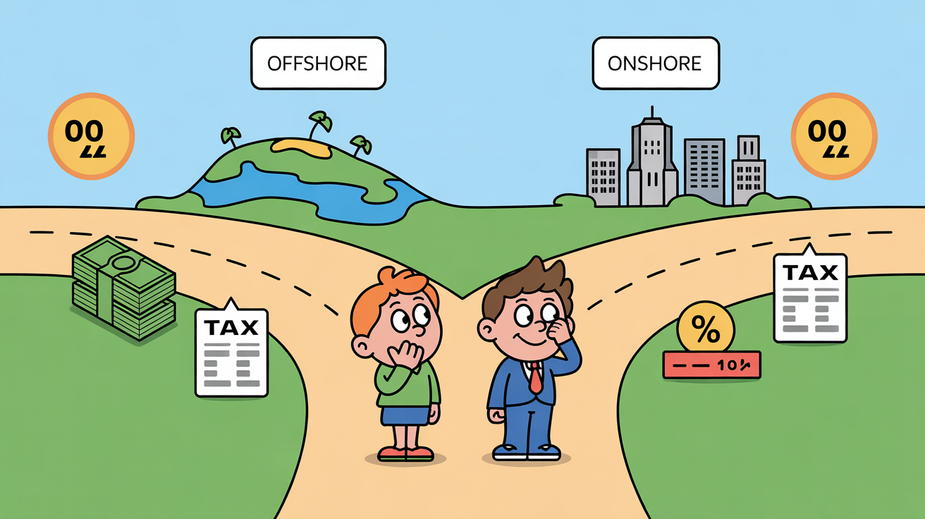

Offshore vs. Onshore Family Offices in Hong Kong: A Tax Comparison Offshore vs. Onshore Family......

Business Continuity Through Strategic Trusts in Hong Kong Navigating the intricate landscape of business succession......

How Family Offices Can Optimize Wealth Preservation Through Hong Kong's Tax Laws Key Facts: Hong......

The Strategic Value of R&D Tax Incentives For small and medium-sized enterprises (SMEs) in Hong......

Essential Tax Deductions for Hong Kong Taxpayers Navigating the intricacies of personal income tax in......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308