📋 Key Facts at a Glance Hong Kong's Free Port Status: Zero customs duties on......

Navigating Hong Kong's Tax Documentation Essentials Understanding and adhering to Hong Kong's tax documentation standards......

Transfer Pricing Fundamentals in the Digital Ecosystem Transfer pricing is the essential mechanism by which......

📋 Key Facts at a Glance Legal Basis: Sections 5B and 7C of the Inland......

Hong Kong's Territorial Tax System Explained Hong Kong distinguishes itself globally through its territorial basis......

Hong Kong's Capital Gains Tax Stance Explained Hong Kong operates under a territorial principle of......

📋 Key Facts at a Glance Legal Framework: Hong Kong's transfer pricing rules are codified......

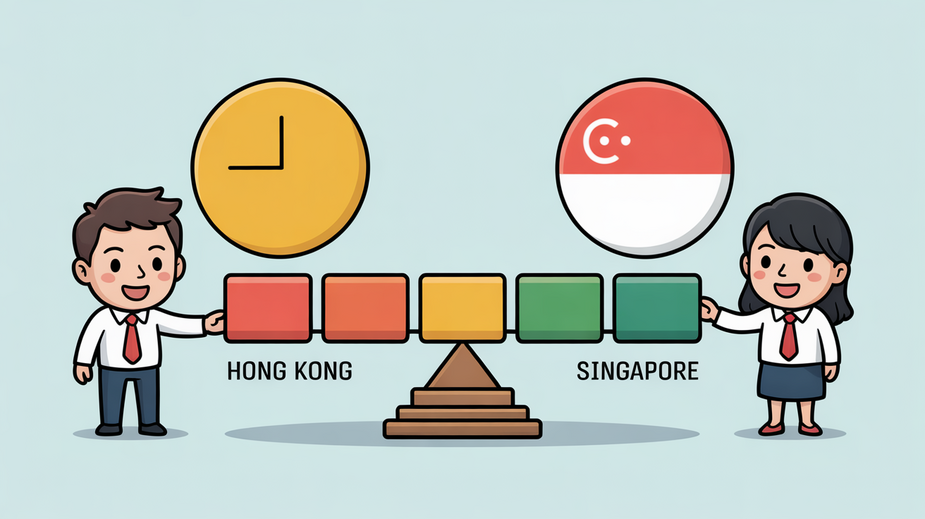

Hong Kong vs. Singapore: Which Jurisdiction Offers Better Tax Efficiency for Family Offices? Hong Kong......

📋 Key Facts at a Glance Territorial Taxation: Only Hong Kong-sourced income is taxable; offshore......

📋 Key Facts at a Glance Property Tax Rate: 15% on net assessable value of......

📋 Key Facts at a Glance Zero Luxury Tax: Hong Kong imposes no VAT, GST,......

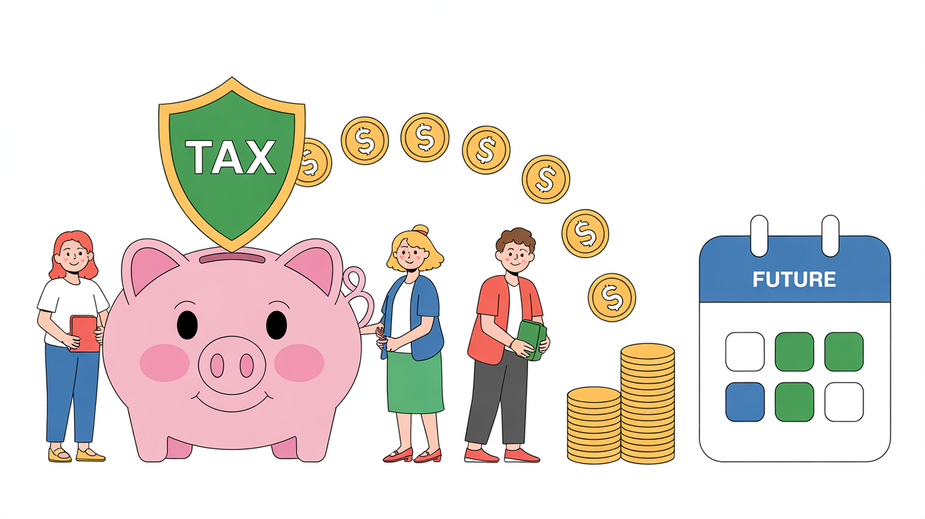

Understanding Tax-Deferred Annuity Basics Tax-deferred annuity schemes in Hong Kong represent a fundamental tool in......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308