Understanding Hong Kong Profits Tax Exemptions for Startups Hong Kong is renowned for its straightforward,......

Understanding Hong Kong's Territorial Tax System Navigating the tax landscape in Hong Kong fundamentally relies......

Why Double Taxation Threatens Global Business Growth Operating a business across international borders offers significant......

Understanding Hong Kong's Territorial Tax System One of the most significant advantages of the Hong......

📋 Key Facts at a Glance Strict Deadlines: Taxpayers have only one month from receiving......

📋 Key Facts at a Glance Annual Deadline: May 31, 2025 (for 2024 calendar year......

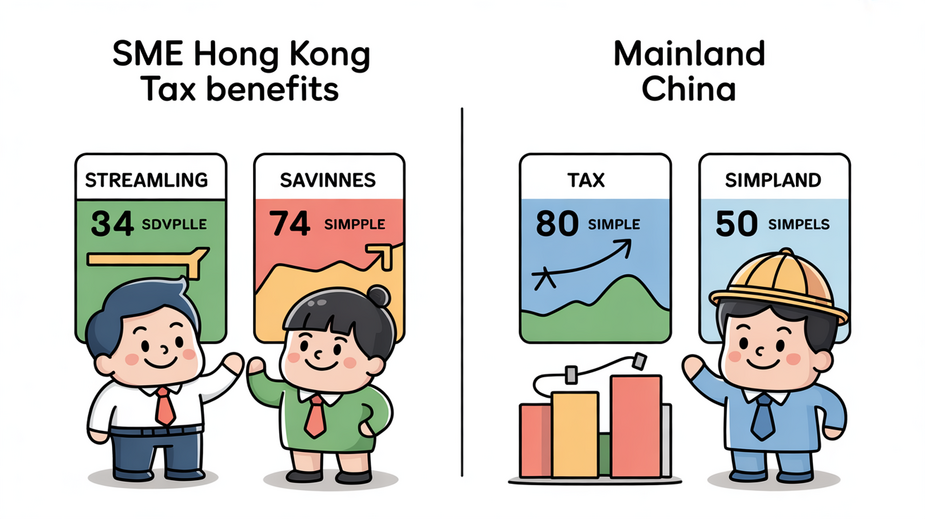

📋 Key Facts at a Glance Two-Tier Profits Tax: 8.25% on first HK$2 million, 16.5%......

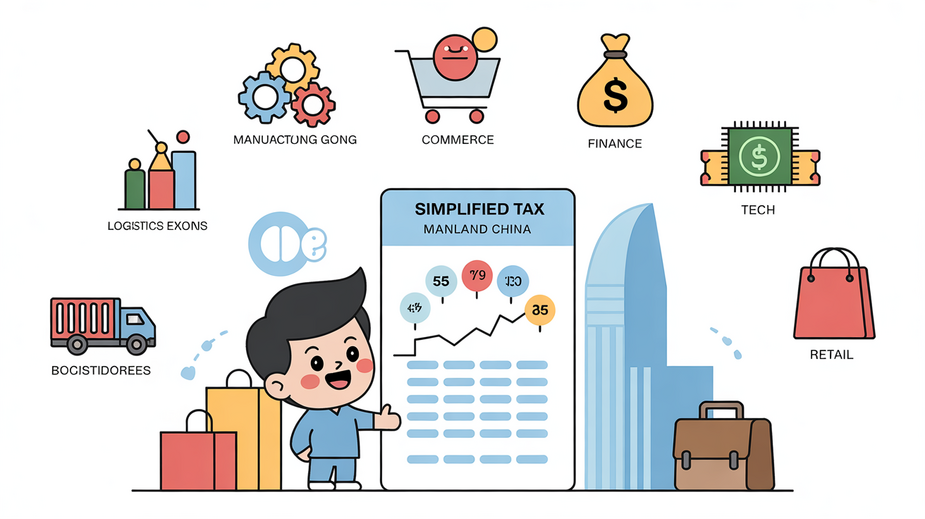

📋 Key Facts at a Glance China-Hong Kong DTA: Dividend withholding tax reduced to 5%......

Capital Allowances 101: Core Concepts Demystified Understanding capital allowances is a fundamental aspect of tax......

📋 Key Facts at a Glance Two Audit Types: The IRD conducts desk audits (document......

📋 Key Facts at a Glance FIHV Regime: 0% profits tax on qualifying investment income......

Hong Kong's SME Tax Framework: Key Features Hong Kong presents a highly appealing environment for......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308