Hong Kong's Appeal for Family Offices and Underlying Tax Complexities Hong Kong has firmly established......

Deadline-Driven Deductions to Prioritize As the calendar year approaches its end, taxpayers in Hong Kong......

📋 Key Facts at a Glance Tax Rate: 0% concessionary rate on qualifying transactions for......

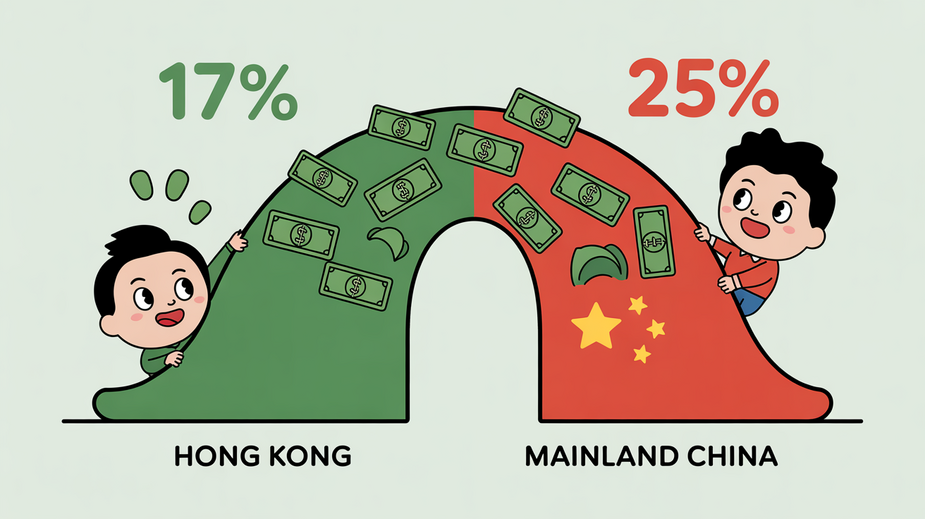

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

The Evolution of Transfer Pricing in Hong Kong Transfer pricing within Hong Kong's tax landscape......

The Future of Hong Kong's Tax Regime for Family Offices: Trends and Predictions The Future......

Strategic Value of the Hong Kong-Germany Double Taxation Agreement The economic relationship between Hong Kong......

BEPS 2.0: Reshaping Global Tax Standards The global tax landscape is undergoing a significant transformation......

📋 Key Facts at a Glance Global Minimum Tax: Hong Kong enacted Pillar Two legislation......

Common Misconceptions About Offshore Claims For businesses operating internationally through a Hong Kong entity, the......

📋 Key Facts at a Glance Zero Dividend Withholding Tax: Hong Kong imposes no withholding......

📋 Key Facts at a Glance Property Tax: 15% flat rate on net rental income......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308