Understanding Rental Losses in Hong Kong Property Tax In Hong Kong's property tax system, a......

📋 Key Facts at a Glance Simplified Stamp Duty Regime: All demand-side measures (BSD, SSD,......

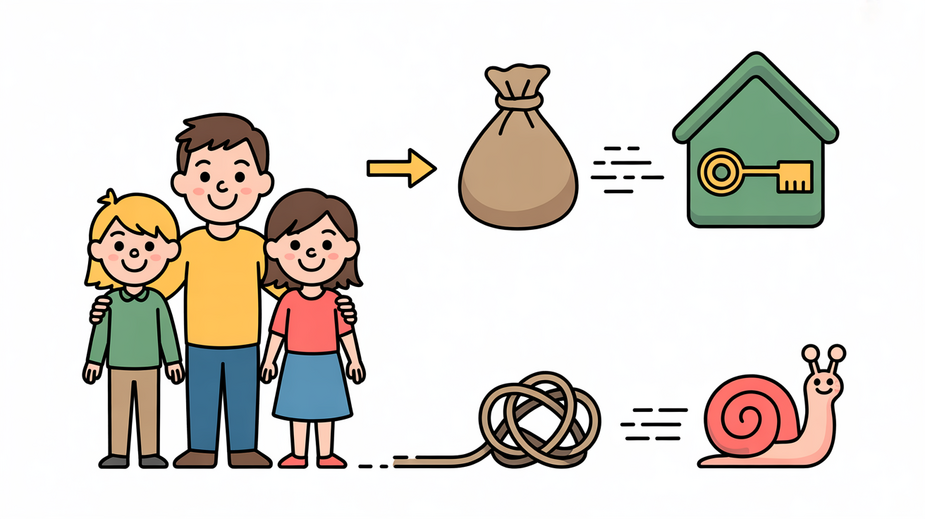

Understanding Wills in Hong Kong's Legal Framework Establishing a valid will in Hong Kong is......

📋 Key Facts at a Glance Simplified System: All property buyers now face the same......

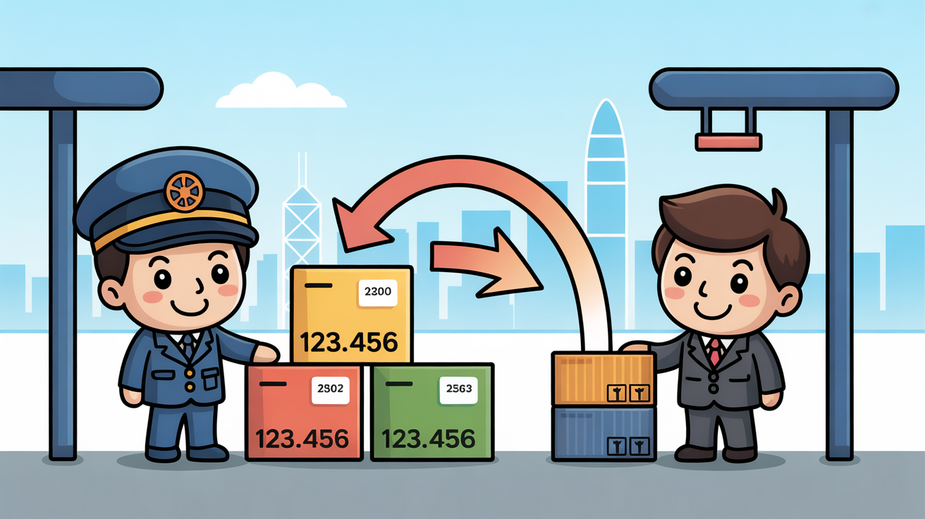

📋 Key Facts at a Glance Hong Kong Free Port Status: No customs duties on......

📋 Key Facts at a Glance Current Rate: 0.2% total on Hong Kong stock transfers......

📋 Key Facts at a Glance Stock Transfer Rate: 0.2% total (0.1% buyer + 0.1%......

📋 Key Facts at a Glance Global Standard: HS codes are used by over 200......

📋 Key Facts at a Glance Strict Deadlines: You must file objections within 1 month......

Redefining Inheritance in a Dynamic Financial Landscape The concept of inheritance is undergoing a fundamental......

📋 Key Facts at a Glance Universal Application: Hong Kong applies property rates equally to......

📋 Key Facts at a Glance Rateable Value ≠ Market Value: RV is estimated annual......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308