Understanding Hong Kong Trust Structures Establishing a trust in Hong Kong offers a sophisticated legal......

Hong Kong's Territorial Source Principle and Profits Tax Hong Kong operates under a territorial source......

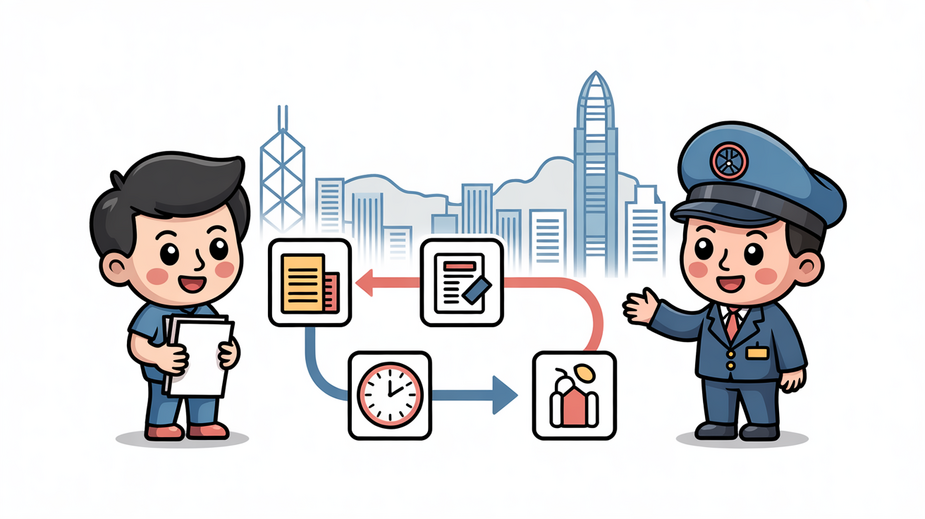

Key Facts Written objections must be filed within 1 month of the assessment date to......

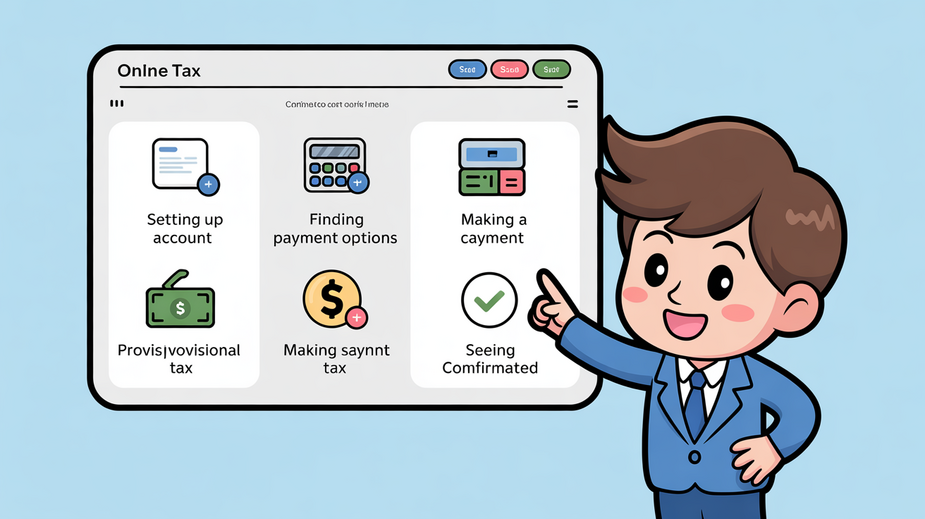

How to Use Hong Kong's eTAX Portal for Provisional Tax Payments Key Facts: Hong Kong......

Navigating Hong Kong Tax Disputes: A Step-by-Step Guide for Foreign Entrepreneurs Key Facts: Hong Kong......

Key Facts Offshore claims remain the IRD's primary audit focus area, with stricter scrutiny on......

Key Facts The IRD uses an "assess first, audit later" approach with no fixed audit......

Tax Residency Definitions and Implications Understanding where you are considered a tax resident is the......

Key Facts: Stamp Duty on Stock Options and Warrants Current Rate: 0.2% total on Hong......

Defining a Permanent Establishment (PE) under Hong Kong Treaties Understanding what constitutes a Permanent Establishment......

Key Facts: Hong Kong Stamp Duty Compliance Filing Deadlines: 2 days for contract notes (Hong......

Navigating the complexities of compensation in Hong Kong requires a clear understanding of how different......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308