Understanding the OECD’s CRS Framework The Common Reporting Standard (CRS), an initiative spearheaded by the......

Hong Kong's Tax Treatment of Family Office Investment Funds: What You Need to Know Hong......

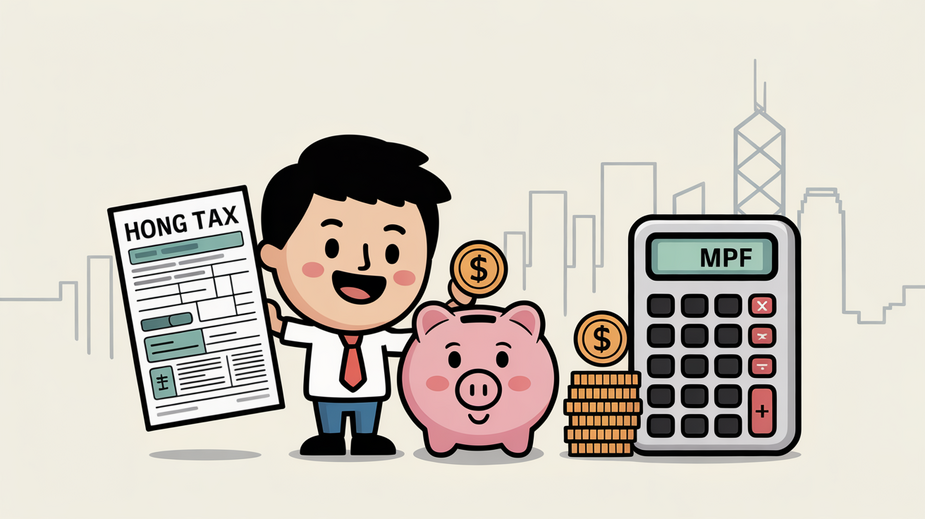

Hong Kong's Tax System: Key Features for Expats Hong Kong offers a remarkably straightforward and......

Maximising Tax Deductions for Hong Kong SMEs: A Guide to Eligible Office and Operational Costs......

📋 Key Facts at a Glance Digital Transformation: IRD's "Assess First, Audit Later" (AFAL) system......

Hong Kong's Advantageous Tax Framework for SMEs Hong Kong's tax system offers distinct advantages for......

📋 Key Facts at a Glance Hong Kong's Free Port Status: 99% of goods enter......

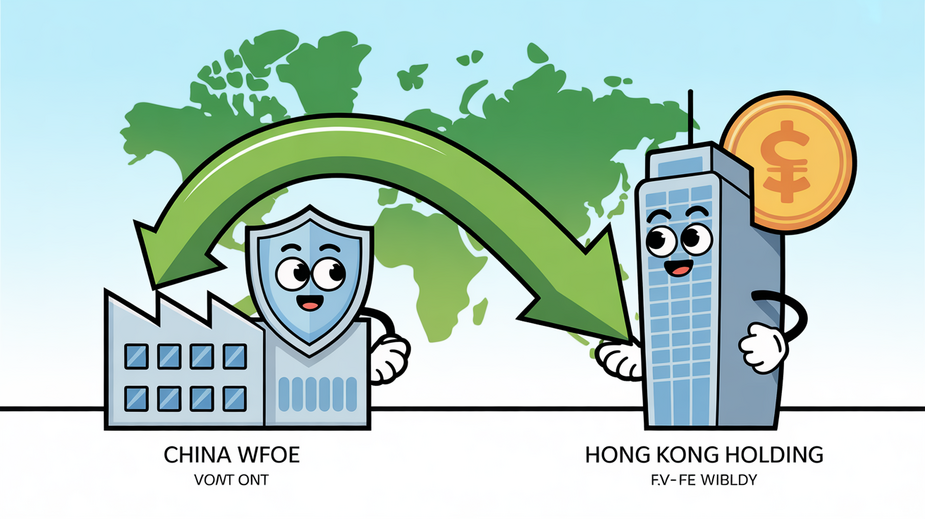

Tax Efficiency Advantages for Cross-Border Profits A fundamental benefit of establishing a Hong Kong holding......

📋 Key Facts at a Glance Objection Deadline: One month from the date of issue......

Understanding Offshore Trusts in Hong Kong An offshore trust is a sophisticated legal arrangement where......

Understanding MPF Tax Deduction Fundamentals The Mandatory Provident Fund (MPF) is Hong Kong's compulsory retirement......

📋 Key Facts at a Glance Global Minimum Tax Enacted: BEPS 2.0 Pillar Two legislation......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308