Navigating the Cross-Border Tax Environment in the Greater Bay Area Operating within the Greater Bay......

Understanding Rental Losses in Hong Kong Property Tax In Hong Kong's property tax system, a......

📋 Key Facts at a Glance Correct Authority: The Lands Tribunal handles property rates appeals......

Hong Kong Trust Framework for Tax-Efficient Financing The strategic utilization of a Hong Kong trust......

Identifying Valid Reasons for Amending a Tax Return Filing a tax return in Hong Kong......

Hong Kong’s Unique Tax Landscape for Wealth Transfer Hong Kong presents a distinctive environment for......

Understanding Your Tax Filing Obligations in Hong Kong Embarking on your tax journey as a......

📋 Key Facts at a Glance No VAT/GST: Hong Kong imposes no Value-Added Tax, Goods......

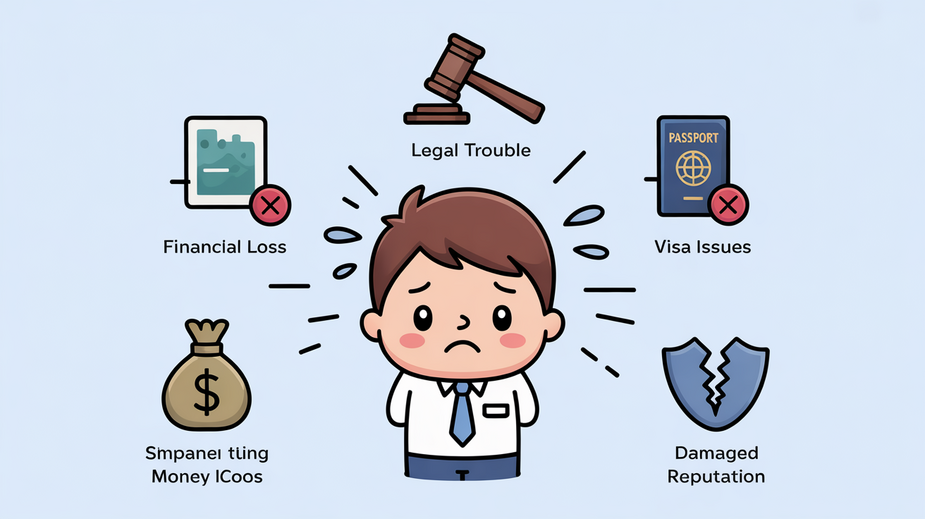

Financial Consequences Beyond Direct Fines Navigating tax obligations in a new country presents inherent complexities.......

Identifying Corporate Tax Audit Triggers in Hong Kong For businesses operating in Hong Kong, understanding......

📋 Key Facts at a Glance Fact 1: Property management fees are NOT separately deductible......

📋 Key Facts at a Glance Hong Kong's Free Port Status: Maintains minimal excise duties......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308