Hong Kong's Advantageous Tax Framework for SMEs Hong Kong's tax system offers distinct advantages for......

Understanding Tax-Deferred Annuity Basics Tax-deferred annuity schemes in Hong Kong represent a fundamental tool in......

Understanding Security Deposits vs. Advance Rent in Hong Kong Taxation Navigating the tax landscape for......

Understanding Hong Kong’s Tax-Efficient Dividend Framework Hong Kong presents a highly attractive tax environment, particularly......

Navigating Permanent Establishment Thresholds in Hong Kong and Mainland China Understanding when a company establishes......

Understanding Employee Stock Options in Hong Kong Employee stock options represent a prevalent form of......

Key Facts: E-Commerce Customs Duties for Hong Kong Sellers Hong Kong is a free port......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

Why Hong Kong for Offshore Holding Structures Establishing an offshore holding structure is a strategic......

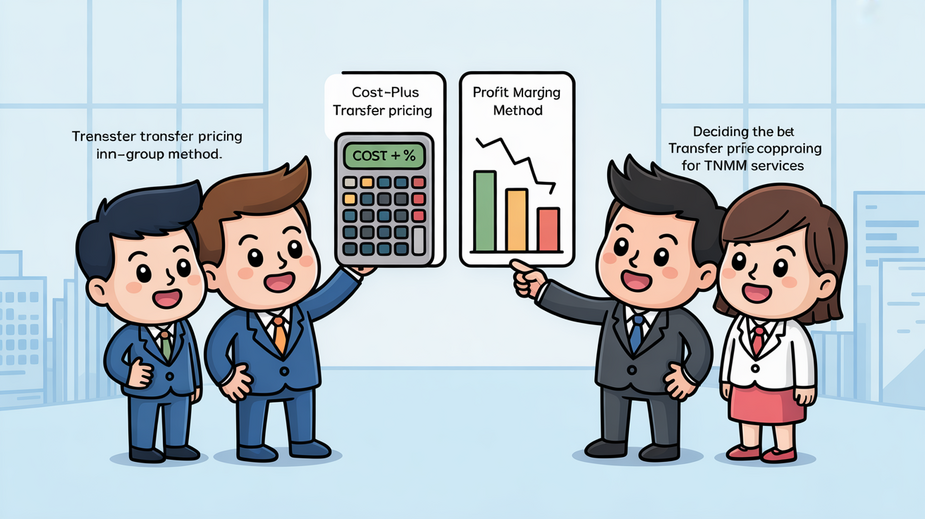

Hong Kong's Transfer Pricing Framework for Services The foundation of Hong Kong's transfer pricing regulations......

Optimizing Your Hong Kong Tax Filing: A Guide to Rental Expense Deductions Navigating your personal......

Common Pitfalls in Digital Tax Filing for Hong Kong SMEs and How to Avoid Them......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308