📋 Key Facts at a Glance No VAT/GST: Hong Kong imposes no Value-Added Tax, Goods......

Core Principles of Hong Kong’s Tax System Hong Kong's tax system is widely recognized for......

The Growing Imperative of Transfer Pricing Compliance The global tax landscape is currently defined by......

Understanding Withholding Tax Fundamentals Withholding tax serves as a foundational element of international taxation, primarily......

📋 Key Facts at a Glance Extended Timelines: Hong Kong tax disputes can span 1-5+......

The Impact of Hong Kong's New Tax Policies on Family Office Investment Structures The Impact......

📋 Key Facts at a Glance Zero Stamp Duty on New Shares: Since 2012, Hong......

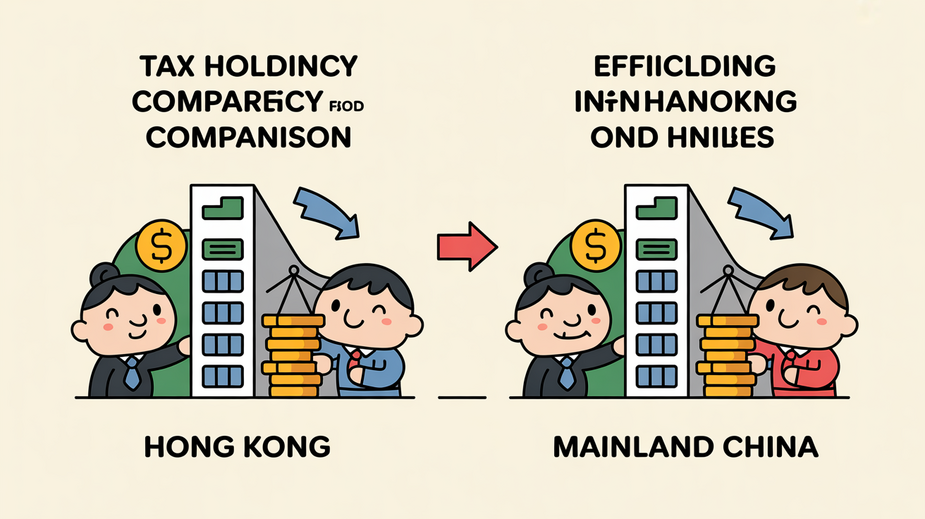

Strategic Importance of Jurisdiction Selection for Holding Structures Choosing the optimal jurisdiction for establishing a......

Understanding Hong Kong's Transfer Pricing Framework in a Global Context Hong Kong has established a......

Core Features of Hong Kong's Tax Framework Hong Kong's enduring appeal as a global financial......

Understanding Hong Kong's Territorial Tax System A defining characteristic and significant appeal of Hong Kong's......

Understanding Hong Kong’s Double Tax Treaty Network Double Tax Treaties (DTTs) are crucial international agreements......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308