The Future of Hong Kong's Tax Regime for Family Offices: Trends and Predictions The Future......

Understanding Family Offices in Hong Kong Family offices are sophisticated private wealth management structures designed......

Understanding Estate Freezing Fundamentals Estate freezing is a strategic estate planning technique designed to limit......

Understanding Rental Durations and Tax in Hong Kong Navigating Hong Kong's property market as an......

Evolving Regulatory Landscape in Greater Bay Area Operating across the Hong Kong and Mainland China......

Hong Kong's eTAX Deadlines: Key Dates and Late Filing Penalties Key Facts: Hong Kong Tax......

Understanding Hong Kong's Stance on Capital Gains Tax For numerous foreign investors familiar with complex......

Hong Kong's eTAX for Non-Resident Directors: Compliance Made Simple Hong Kong's eTAX for Non-Resident Directors:......

How Family Offices Can Optimize Wealth Preservation Through Hong Kong's Tax Laws Key Facts: Hong......

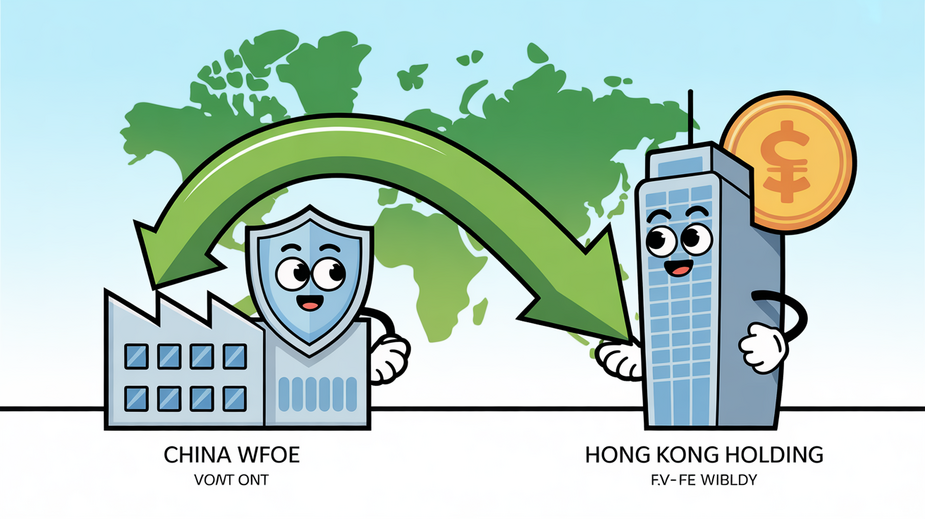

Tax Efficiency Advantages for Cross-Border Profits A fundamental benefit of establishing a Hong Kong holding......

Hong Kong's Tax Compliance Landscape and the Role of Audited Financial Statements Hong Kong's tax......

The Strategic Role of Business Structure in Tax Efficiency Choosing the appropriate business structure is......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308