Understanding Hong Kong Property Tax Obligations Renting out a residential property in Hong Kong entails......

Hong Kong's Appeal for Expat Asset Management Hong Kong stands as a premier international financial......

📋 Key Facts at a Glance Treaty Name: Arrangement between Mainland China and Hong Kong......

BEPS 101: Reshaping Global Tax Governance The Base Erosion and Profit Shifting (BEPS) initiative, spearheaded......

Hong Kong's Tax Treatment of Family Office Investment Funds: What You Need to Know Hong......

📋 Key Facts at a Glance China-Hong Kong DTA: Dividend withholding tax reduced to 5%......

📋 Key Facts at a Glance Progressive Rating System: Effective January 1, 2025 for high-value......

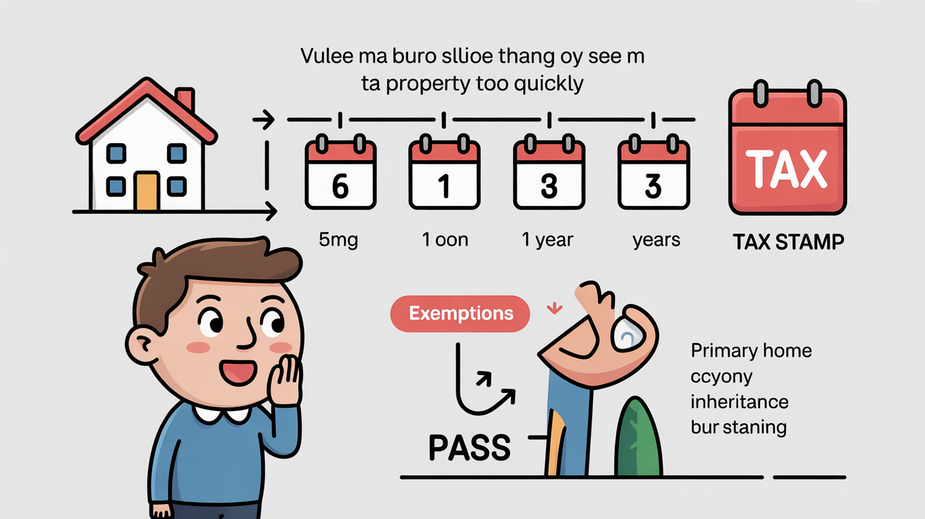

📋 Key Facts at a Glance Stock Transfer Stamp Duty: 0.1% per party (0.2% total)......

Hong Kong’s Evolving Transfer Pricing Regulatory Landscape Hong Kong's transfer pricing framework, particularly concerning intellectual......

Core Principles of Hong Kong's Profits Tax System Navigating the landscape of business taxation in......

Hong Kong's Tax Landscape for Retirement Savings Navigating retirement planning as an expatriate involves a......

📋 Key Facts at a Glance Complete Abolition: Special Stamp Duty (SSD) was abolished on......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308