Understanding Advanced Pricing Agreements (APAs) and Hong Kong's Framework Advanced Pricing Agreements (APAs) represent a......

📋 Key Facts at a Glance Enforcement Timeline: Hong Kong's transfer pricing rules have been......

📋 Key Facts at a Glance Hong Kong's Free Port Status: 99% of goods enter......

📋 Key Facts at a Glance Standard Rate: Property tax is charged at 15% on......

📋 Key Facts at a Glance Strict Deadlines: Taxpayers have only one month from receiving......

Hong Kong's Competitive and Territorial Tax System Hong Kong stands as a preeminent international financial......

Core Principles of Territorial vs. Worldwide Tax Systems Understanding the fundamental differences between territorial and......

📋 Key Facts at a Glance Tax-Free Dividends: Hong Kong does not tax dividends received......

Understanding Hong Kong Reserved Powers Trusts A Reserved Powers Trust (RPT) under Hong Kong law......

Understanding Hong Kong’s Two-Tiered Tax System for High Earners Hong Kong features a distinctive tax......

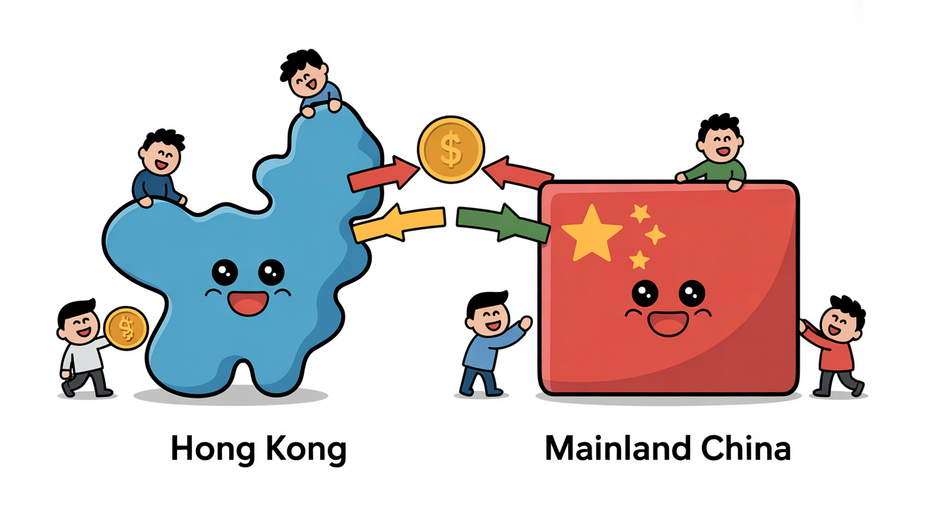

Hong Kong vs Mainland China Tax Systems Compared Navigating the distinct tax landscapes of Hong......

📋 Key Facts at a Glance Treaty Name: Arrangement between Mainland China and Hong Kong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308