Understanding Hong Kong's Capital Gains Tax Framework Hong Kong is renowned globally as an attractive......

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

Hong Kong's Strategic Advantage in Cross-Border Wealth Management Hong Kong stands as a preeminent international......

Immediate Financial Penalties for Late Tax Returns Failing to submit your Hong Kong tax return......

Understanding Hong Kong's Audit Compliance Landscape Navigating the complexities of taxation and regulatory compliance is......

Hong Kong's Territorial Tax System for E-Commerce Hong Kong operates under a territorial basis of......

Understanding Hong Kong's Two-Tier Tax Structure Hong Kong's profits tax system features a distinctive two-tiered......

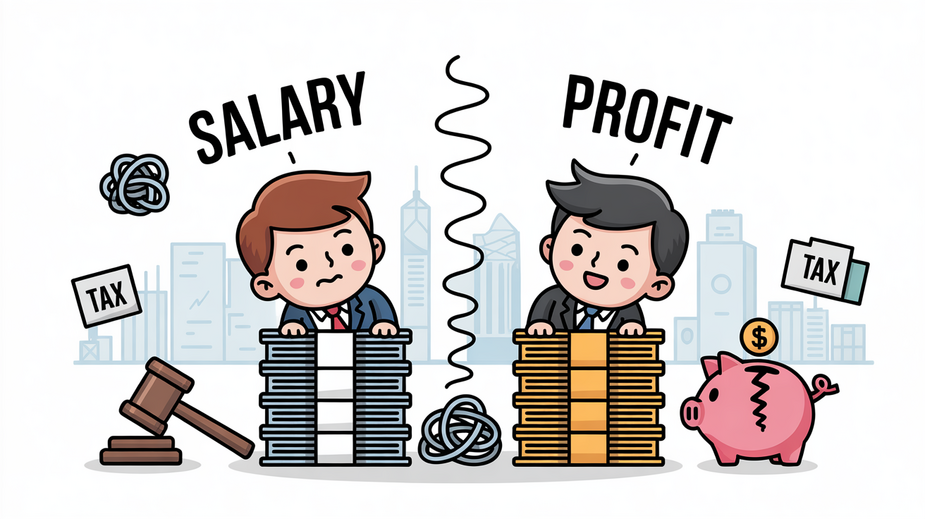

The Crucial Distinction: Director Remuneration vs. Profit Distribution in Hong Kong In Hong Kong corporate......

Hong Kong's Distinct Tax Framework Hong Kong operates under a highly distinct and globally recognized......

Understanding Hong Kong's Property Tax Framework Hong Kong's property tax system is a fundamental element......

Core Tax Obligations for Cross-Border E-Commerce Hong Kong businesses aiming to access the significant consumer......

Understanding Hong Kong’s Two-Tiered Tax System for High Earners Hong Kong features a distinctive tax......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308