📋 Key Facts at a Glance Territorial Tax Principle: Only Hong Kong-sourced profits are taxable......

📋 Key Facts at a Glance Free Port Status: Hong Kong imposes no customs duties......

📋 Key Facts at a Glance Current Stamp Duty Rate: 0.1% per party (0.2% total......

Mainland Economic Activities and Tax Presence A company registered in Hong Kong may establish a......

📋 Key Facts at a Glance China's VAT Law Upgrade: Comprehensive VAT legislation passed December......

Eligibility Criteria for Dependent Parent Allowances Securing dependent parent allowances in Hong Kong requires meeting......

Hong Kong's Tax Landscape for Digital Commerce Hong Kong operates under a fundamental and distinct......

Understanding Trust Structures in Hong Kong A trust is a fundamental legal arrangement frequently employed......

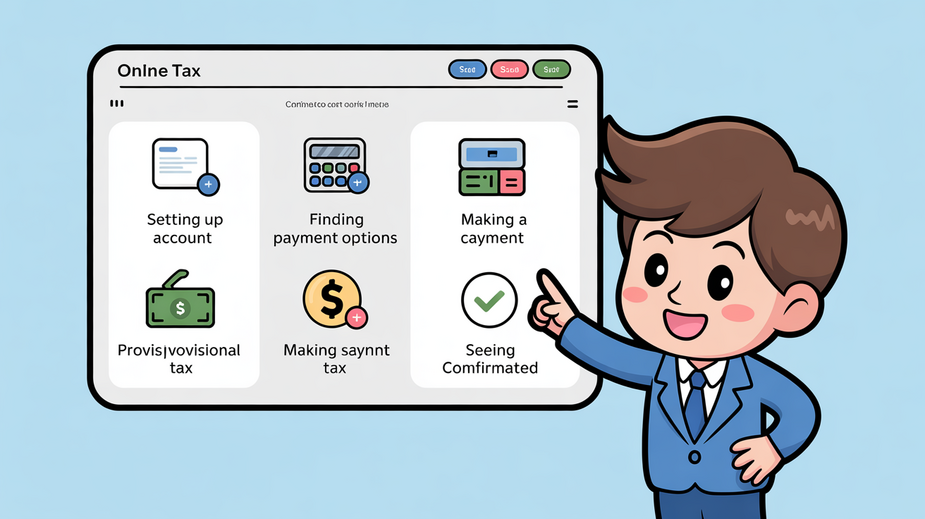

📋 Key Facts at a Glance Payment Structure: 75% first installment (typically January), 25% second......

📋 Key Facts at a Glance Critical Deadline: You have only one month to file......

Understanding Hong Kong's Tax Filing Options for Married Couples Married couples in Hong Kong navigate......

📋 Key Facts at a Glance Tax Rate: 15% flat rate on Net Assessable Value......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308