Understanding Hong Kong Reserved Powers Trusts A Reserved Powers Trust (RPT) under Hong Kong law......

📋 Key Facts at a Glance Global Minimum Tax: 15% minimum effective tax rate for......

Profits Tax Fundamentals for Hong Kong Businesses Operating a business in Hong Kong requires a......

Understanding Hong Kong's Stance on Capital Gains Tax For numerous foreign investors familiar with complex......

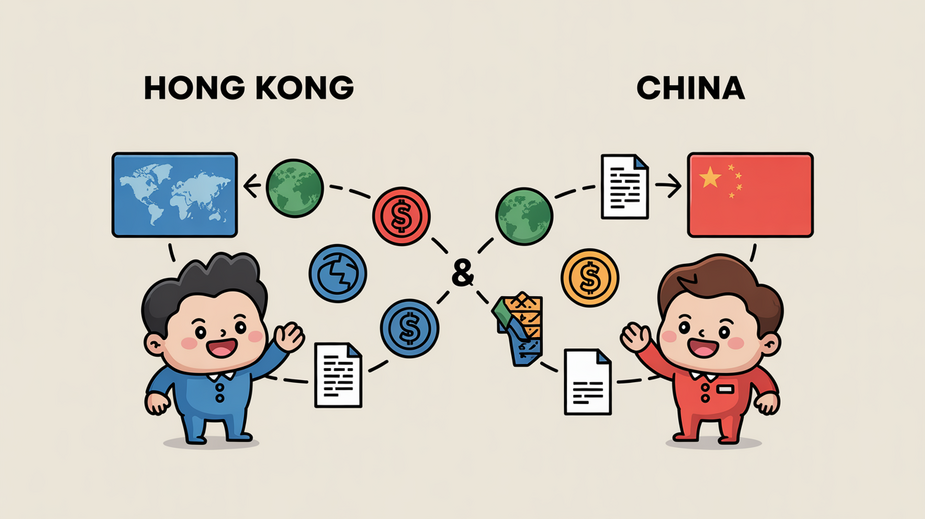

DTA Networks: Scope and Global Reach Double Tax Avoidance (DTA) treaties are essential tools for......

Basics of Hong Kong Provisional Tax Provisional tax in Hong Kong functions as an advance......

Tax Filing Implications of Marriage in Hong Kong Getting married in Hong Kong is a......

Hong Kong's Tax Fundamentals for Cross-Border Structures Understanding the foundational principles of Hong Kong's tax......

📋 Key Facts at a Glance Tax Rates: Progressive rates from 2% to 17% OR......

Mastering Hong Kong Salaries Tax: A Guide to Avoiding Common Mistakes Navigating the intricacies of......

📋 Key Facts at a Glance Current Rate: 0.1% each for buyer and seller (0.2%......

Understanding Hong Kong's Capital Gains Tax Framework Individuals managing investments or operating within Hong Kong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308