Understanding Hong Kong's Profits Tax Obligations Navigating the landscape of business taxation in Hong Kong......

📋 Key Facts at a Glance Equity Stamp Duty Rate: 0.1% per party (0.2% total)......

Capital Allowances 101: Core Concepts Demystified Understanding capital allowances is a fundamental aspect of tax......

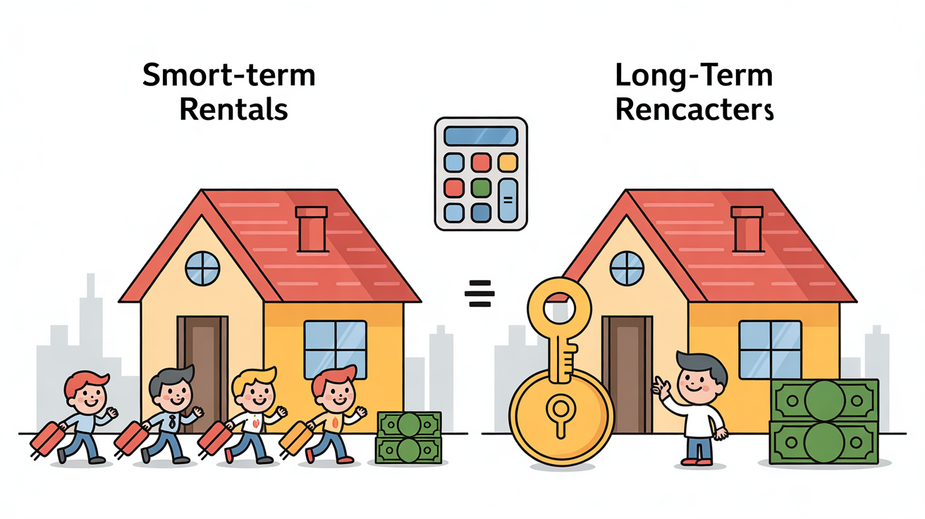

Understanding Rental Durations and Tax in Hong Kong Navigating Hong Kong's property market as an......

Hong Kong's Retirement Savings Reality Check Navigating the path to a secure retirement in Hong......

📋 Key Facts at a Glance Immediate 5% surcharge: Applied immediately on unpaid tax after......

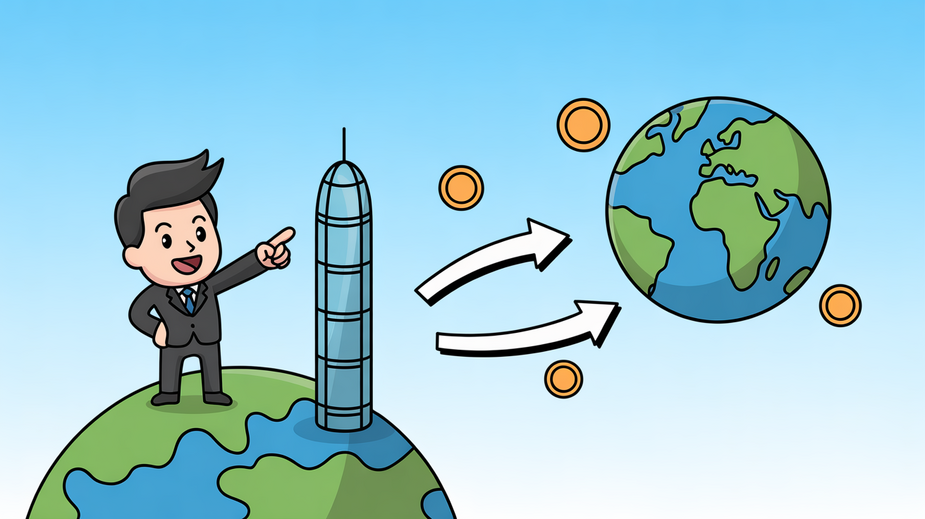

Hong Kong's Territorial Tax System Explained One of the most compelling reasons smart entrepreneurs choose......

Understanding Hong Kong Profits Tax Deadlines Navigating the landscape of Hong Kong's taxation necessitates a......

Fundamentals of Double Taxation Treaties (DTTs) Double Taxation Treaties, or DTTs, represent foundational international agreements......

📋 Key Facts at a Glance 1-Month Deadline: You have exactly one month from the......

Hong Kong's Territorial Tax System Explained Hong Kong operates a distinctive tax system based on......

Understanding Hong Kong's Stamp Duty Basics Stamp duty constitutes a significant transaction cost within the......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308