Key Facts: Hong Kong Property Stamp Duty Major Policy Change: All demand-side management measures (BSD,......

Navigating Hong Kong's Distinctive Tax System: A Guide for Foreign Entrepreneurs Hong Kong operates under......

Addressing Cross-Border Tax Complexities for a Global Entrepreneur International expansion presents significant opportunities for thriving......

Key Facts The Board of Review is an independent statutory body that hears tax appeals......

Hong Kong's Business Exit Landscape in 2024 Navigating a business exit in Hong Kong during......

Hong Kong’s Unique Tax Landscape for Wealth Transfer Hong Kong presents a distinctive environment for......

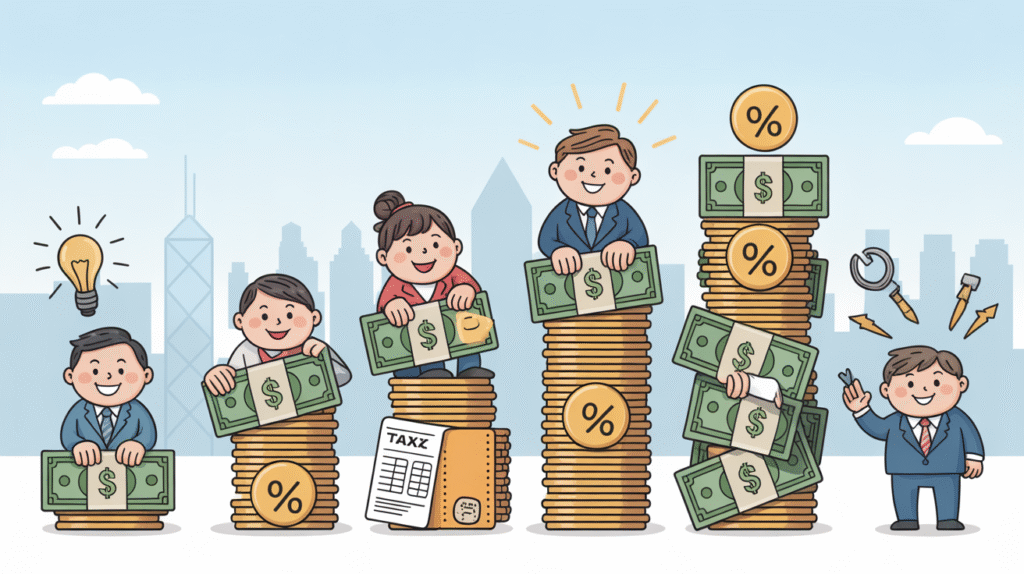

Understanding Hong Kong's Two-Tiered Salaries Tax System Hong Kong employs a distinctive two-tiered system for......

📋 Key Facts at a Glance Property Tax Rate: 15% on Net Assessable Value (rental......

📋 Key Facts at a Glance No Gift Tax: Hong Kong has no gift tax,......

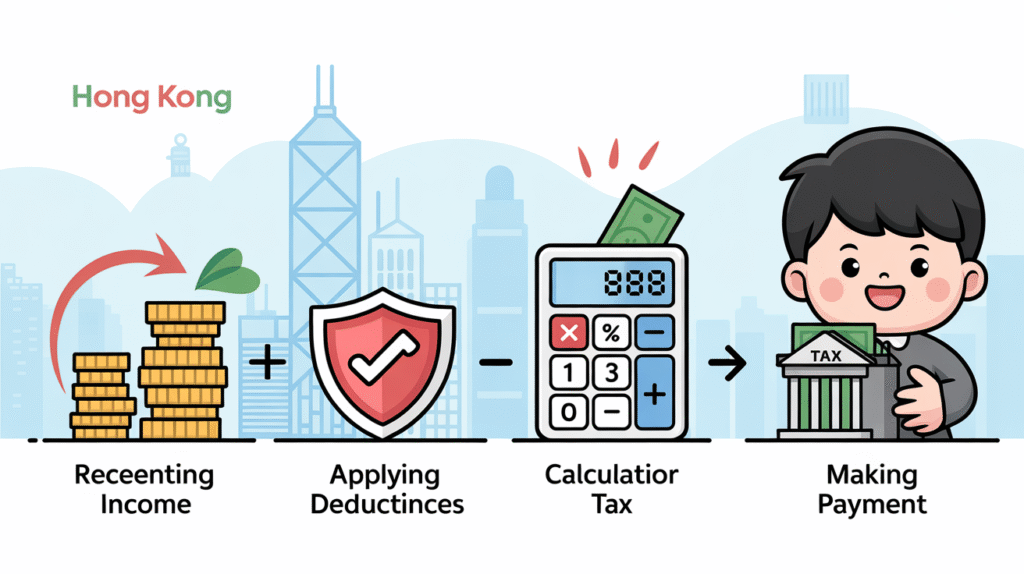

Understanding Hong Kong Salaries Tax Fundamentals Navigating the Hong Kong tax system begins with grasping......

Hong Kong's Evolving Approach to Taxing the Gig Economy: Regulatory Grey Areas Hong Kong's Evolving......

Understanding Hong Kong's Territorial Tax System Navigating the tax landscape in Hong Kong fundamentally relies......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308